Baidu's Strategic Evolution: 2024's Financial Outlook and Growth Avenues

Unveiling Baidu's Financial Resilience: From AI Innovation to Cloud Expansion and Autonomous Ventures, A Closer Look at Baidu's Journey Toward Market Leadership and Investment Potential | That's TradingNEWS

Baidu, Inc. (NASDAQ:BIDU): An In-Depth Financial and Strategic Analysis

Baidu, Inc. (NASDAQ:BIDU), a leader in China's rapidly evolving internet sector, has positioned itself as a pivotal player in the artificial intelligence (AI), cloud computing, autonomous driving, and digital content streaming arenas. This comprehensive analysis delves into Baidu's financial performance, strategic initiatives, and future growth prospects, informed by detailed data and projections.

Financial Overview and Growth Trajectories

Robust Revenue Streams Across Diverse Segments

-

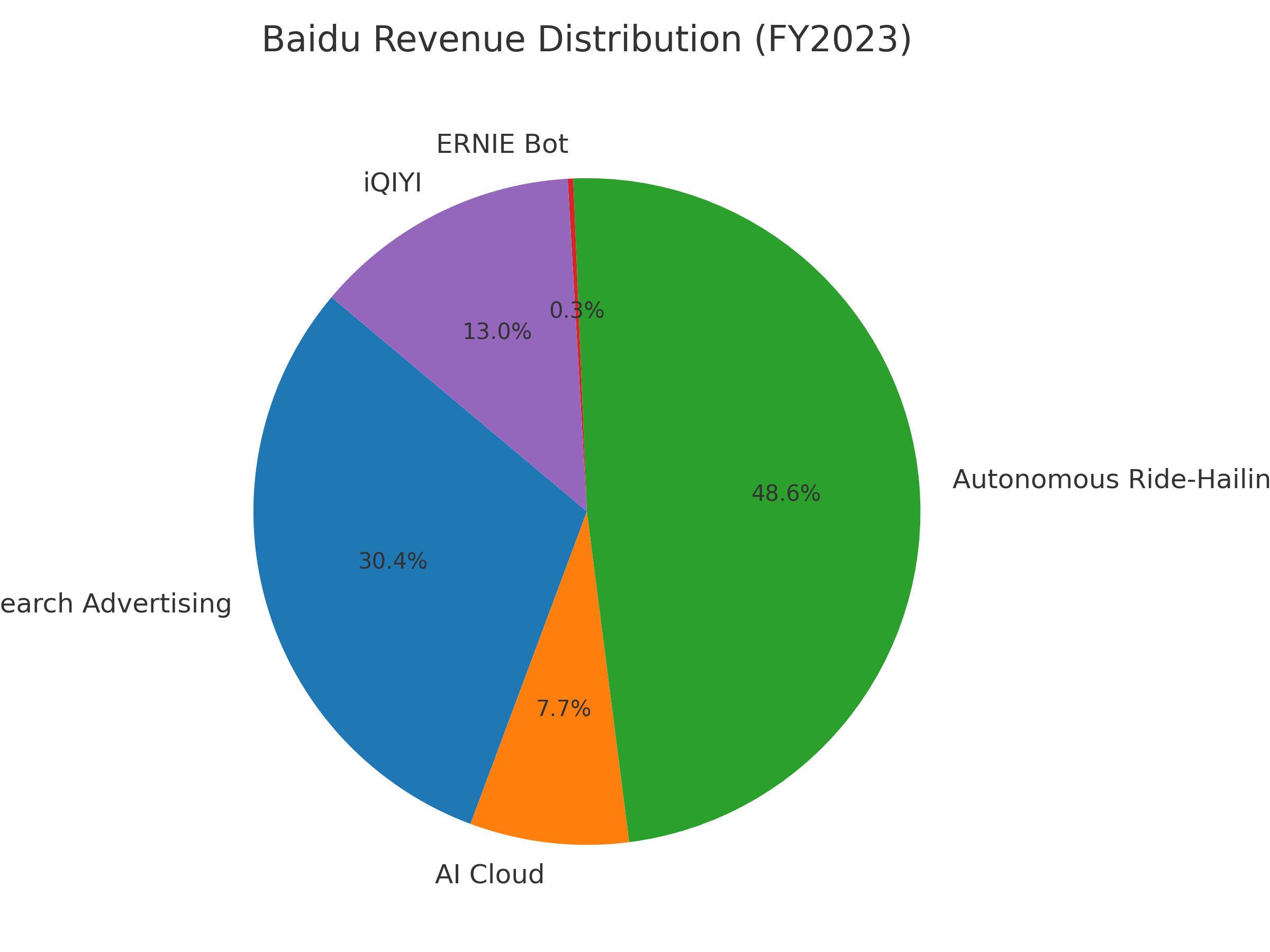

Search Advertising Business: Baidu's search advertising segment, the cornerstone of its revenue, brought in CNY 75.1 billion in FY2023, signifying over half of the total CNY 135 billion revenue. This segment benefits from China's growing digital advertising market and Baidu's dominant market share.

-

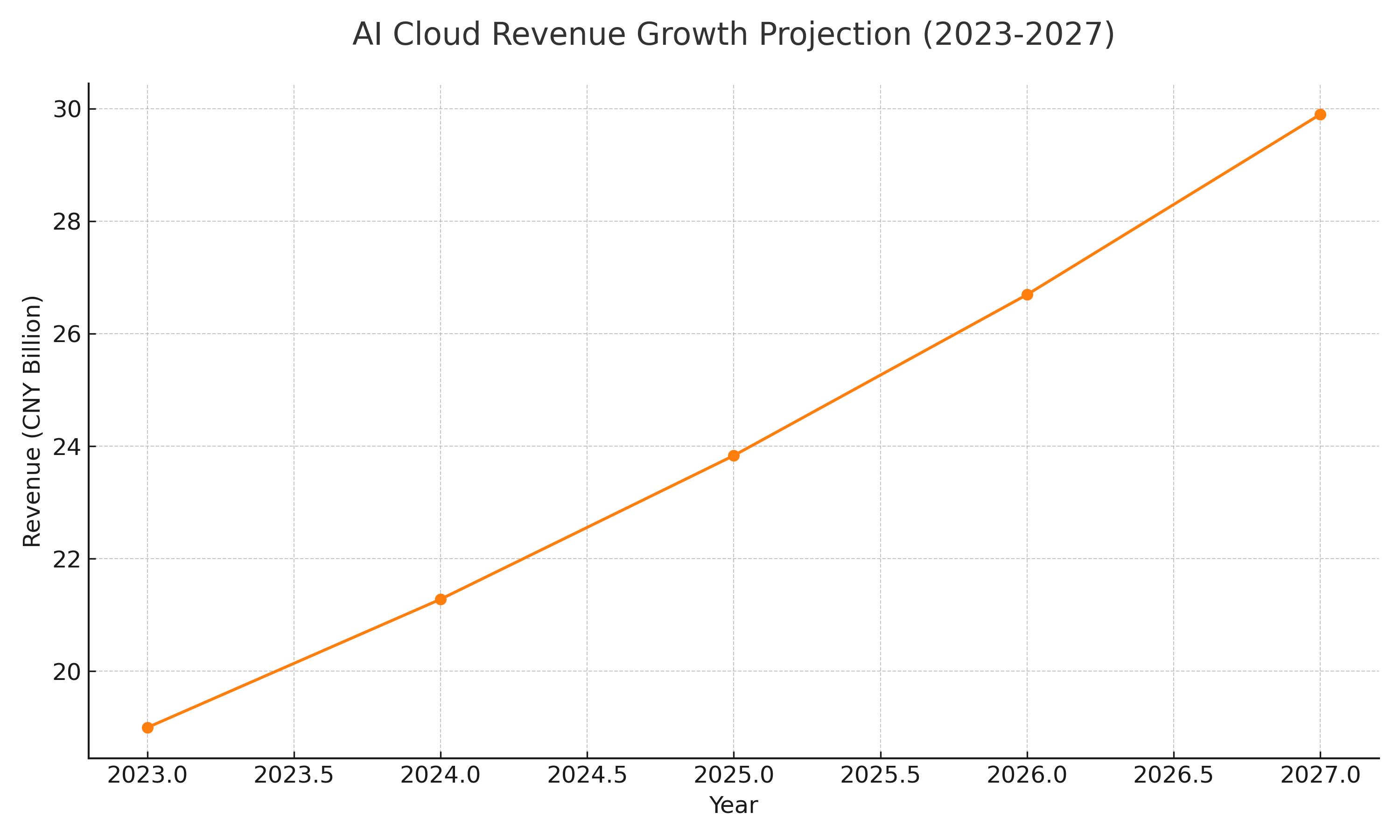

AI Cloud Expansion: The AI Cloud segment recorded revenues of CNY 19 billion in FY2023. Forecasted to grow at a 12% annual rate over the next five years, it epitomizes Baidu's strategic shift towards leveraging cloud computing and AI to diversify income sources.

-

Autonomous Ride-Hailing Potential: Apollo Go, Baidu's autonomous ride-hailing venture, hints at a massive revenue potential within China's ride-hailing market, estimated at CNY 600 billion. A conservative assumption of capturing a 20% market share projects significant revenue growth, enhancing Baidu's financial outlook.

-

ERNIE Bot Monetization: The ERNIE bot, launched in August 2023, contributed CNY 656 million in Q4 2023 alone, underscoring its potential as a new revenue stream through both advertising enhancements and subscription models. Projections suggest a user base growth could translate into substantial revenues of CNY 17.6 billion, assuming a 4% conversion rate.

-

iQIYI's Path to Profitability: iQIYI, Baidu's streaming service, reported its first profit with a 4% margin on CNY 32 billion in revenues for FY2023. Expected to grow at a 6% annual rate, iQIYI could become a significant contributor to Baidu's profitability with projected revenues reaching CNY 54 billion.

Valuation Insights and Earnings Projections

Aggregating future earnings from Baidu's diversified business segments suggests potential earnings exceeding CNY 32 billion at the start of the terminal period, a significant uptick from the current net profit of CNY 21.8 billion in FY2023. This analysis indicates that Baidu is currently undervalued, with a potential valuation nearly double its present market cap of USD 34 billion. Such underestimation presents a strategic buying opportunity for investors with an appetite for high-risk, high-reward investments.

Risks and Mitigation Strategies

Investing in Baidu entails navigating challenges such as intense market competition, regulatory uncertainties, and the dependence on China's economic landscape. Additionally, restricted access to cutting-edge chips poses a technological hurdle for Baidu's AI ambitions. However, Baidu's resilience, demonstrated through strategic partnerships and innovation, mitigates these risks, positioning the company for sustained growth.

Strategic Initiatives and Competitive Edge

Baidu's investment in AI and cloud computing not only diversifies its revenue streams but also enhances its services, including the core search business. The launch of Apollo Go and the monetization of ERNIE bot exemplify Baidu's commitment to innovation and market leadership in AI. Furthermore, iQIYI's turnaround to profitability highlights Baidu's ability to navigate the competitive streaming landscape effectively.

Conclusion: A Strategic Investment with Long-term Growth Potential

Baidu's comprehensive growth strategy, dominant market position in China's AI space, and significant undervaluation based on detailed financial projections make it an attractive investment. While acknowledging the associated risks, Baidu's strategic diversification, innovation, and market leadership underscore its potential for long-term growth and profitability. Investors are encouraged to monitor Baidu's progress closely, considering the volatile nature of the tech sector and the broader economic environment.

That's TradingNEWS

Read More

-

CGDV ETF at $44.17 Targets $52 as Dividend Value and AI Leaders Drive 2026 Upside

07.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETFs XRPI and XRPR: $2.20 XRP and $1.6B Inflows Drive 2026’s Hottest Crypto Trade

07.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast: NG=F Rebounds to $3.48 as Market Eyes EIA Storage Shock

07.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds 156.6 as BoJ Hawkish Shift Collides With Fed Cut Expectations

07.01.2026 · TradingNEWS ArchiveForex