Bitcoin's Bullish Surge Driven by Fed Rate Cut Speculations

Bitcoin Nears Record Highs Amid Rate Cut Speculation | That's TradingNEWS

Bitcoin's Bullish Momentum: An In-Depth Analysis

Bitcoin Nears Record Highs Amid Rate Cut Speculation

Bitcoin has edged higher, trading at $71,878.6 by 08:22 ET (12:22 GMT), marking a 1% increase over the past 24 hours. The cryptocurrency is set to gain over 5% this week, breaking out of its $60,000 to $70,000 trading range established since mid-March. This surge is driven by growing expectations of U.S. interest rate cuts and a weakening dollar, which have bolstered risk assets like Bitcoin.

Rate Cut Bets Mount Ahead of Nonfarm Payrolls Data

Market sentiment is buoyed by the anticipation that the Federal Reserve will begin cutting interest rates by September. Weak U.S. economic data has fueled these expectations, with traders betting that a cooling economy will prompt the Fed to loosen monetary policy. The dollar's decline this week has further supported Bitcoin and other speculative assets. The upcoming nonfarm payrolls data, due later today, is expected to provide more clarity on the labor market and future interest rates.

Institutional Inflows and ETF Hype

Bitcoin is trading just below its record high, as expectations of lower rates have spurred significant institutional capital flows into Bitcoin-linked exchange-traded funds (ETFs). The approval of spot Bitcoin ETFs for U.S. markets earlier this year was a key driver behind Bitcoin's rally to record highs. Analysts suggest that the prospect of lower rates could trigger another record high rally for Bitcoin in the near term.

Technical Analysis: Bitcoin Could Hit $83k Soon

Technical analysts at 10x Research predict that Bitcoin could reach $83,000, driven by a bullish pattern on the daily chart. A move above $72,000 would confirm a breakout from an inverted head-and-shoulders pattern, indicating a potential rally towards $83,000. This pattern, which features three price troughs with the middle one being the deepest, typically signals an upward trend reversal.

Altcoins and Broader Crypto Market Performance

Among broader crypto markets, major altcoins are trading in a tight range, awaiting more cues on U.S. rates. Despite this, most tokens are set for weekly gains amid expectations of lower rates and optimism over a spot Ether ETF. The CoinDesk 20 Index fell 1% over the past 24 hours, with Uniswap's UNI, Chainlink's LINK, and Near's NEAR declining by 3%-5%. In contrast, Cosmos-based Injective's INJ token gained 5% following a tokenomics update aimed at making the asset more deflationary.

Central Bank Rate Cuts and Bitcoin's Market Dynamics

Central banks in developed economies have started easing monetary policy, with the ECB and Denmark's central bank both cutting benchmark rates by 25 basis points. The Bank of Canada lowered rates earlier this week, and the Swiss National Bank cut rates in March. This trend raises the possibility of the U.S. Federal Reserve joining the rate-cutting trend, especially with recent data showing softening inflation and economic growth. The upcoming CPI release could be a significant trigger for Bitcoin's price action.

Bitcoin Price Prediction: Key Levels and Technical Indicators

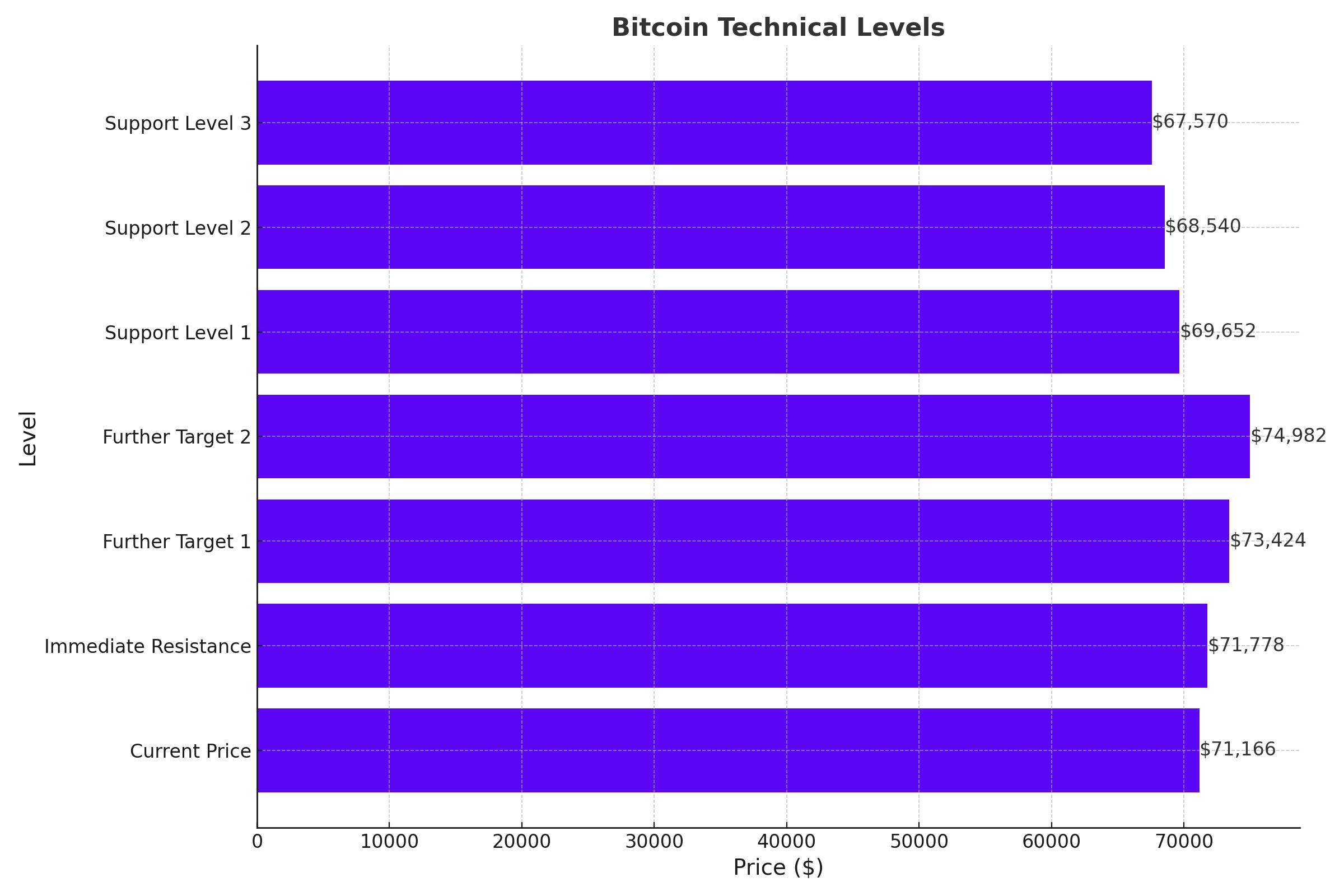

Bitcoin is currently trading at $71,166, having recently broken an asymmetric triangle pattern that previously provided resistance around the $69,600 level. The pivot point at $70,436 is crucial for determining market direction. Immediate resistance is at $71,778, with further targets at $73,424 and $74,982. On the support side, key levels are at $69,652, $68,540, and $67,570.

Technical indicators support a bullish outlook, with the RSI at 65 indicating a moderately overbought condition. The 50 EMA at $69,623 aligns closely with current price action above the pivot point, reinforcing its significance. Despite a recent failure to break through $71,778, leading to a correction to the $70,000 support level, the technical setup suggests potential for continued bullish momentum.

Future Projections: Bitcoin's Path to $100k

Prominent analysts and investors, including Galaxy Digital CEO Mike Novogratz, predict Bitcoin could reach $100,000 by year-end, especially if it surpasses the critical $73,000 level soon. Fundstrat’s Tom Lee also forecasts a surge to $150,000, citing the halving event, Bitcoin ETFs' success, and a growing user base as key drivers.

Conclusion: Bitcoin's Bullish Outlook

Given the current technical setup and positive market conditions, Bitcoin is poised for further gains. Today's strategy involves monitoring the $70,500 level, with a focus on bullish targets. Investors should consider buying above this level to capitalize on potential upward momentum. With significant institutional inflows, supportive macroeconomic conditions, and bullish predictions, Bitcoin remains a strong investment with robust growth prospects in the evolving cryptocurrency landscape.

That's TradingNEWS

Read More

-

PPA ETF Rallies Toward $180 On $1.5T US Defense-Spending Supercycle

19.01.2026 · TradingNEWS ArchiveStocks

-

XRP Price Falls Below $2 But XRPI and XRPR ETFs Keep Absorbing $1.28B Inflows

19.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Soars From $3.10 to $3.59 as Arctic Cold Reignites Henry Hub

19.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Near 158 As Tariff Shock And BoJ Shift Put 160 Ceiling In Focus

19.01.2026 · TradingNEWS ArchiveForex