Broadcom Strategic Evolution Post-VMware Acquisition Terrain

Analyzing Broadcom's Transition to a Software Giant: Financial Health, Market Risks, and Growth Strategies Post-VMware Deal | That's TradingNEWS

Broadcom Inc. (NASDAQ:AVGO): An In-Depth Financial Analysis and Outlook

Transformation Through VMware Acquisition

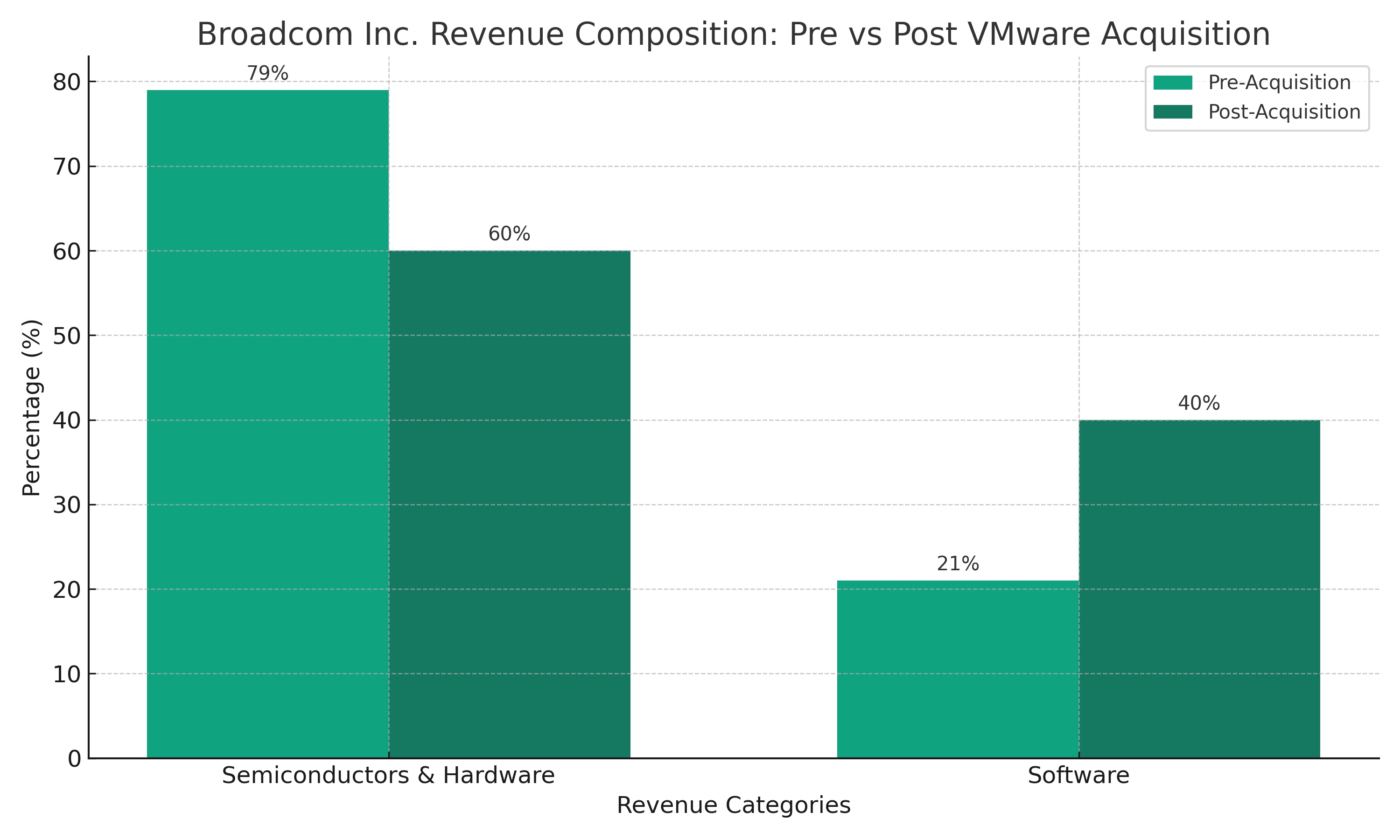

Strategic Shift to Software: Broadcom Inc.'s (NASDAQ: AVGO) significant pivot in 2024, marked by the VMware acquisition, represents a strategic transformation. Pre-acquisition, Broadcom's revenue composition was heavily skewed towards semiconductors and hardware (79%). However, the addition of VMware is set to alter this balance dramatically, with software projected to comprise 40% of the company's revenue. This shift is not just a change in revenue streams; it's a fundamental repositioning in the rapidly evolving tech landscape.

Reduced Customer Concentration Risk: Previously, Broadcom’s top 5 customers constituted 35% of net revenues, with WT Microelectronics alone accounting for a significant 20%. The VMware deal strategically reduces this customer concentration risk. This is particularly crucial given the tech industry's dynamic nature, where long-term contracts, like the one with Apple, can swiftly evolve.

Broadcom's Market Positioning and Portfolio

Strong Synergies with VMware: The acquisition of VMware, a leader in cloud software, augments Broadcom's existing product portfolio. This integration is expected to enhance Broadcom's presence in the generative AI market, particularly through VMware's collaboration with NVIDIA via the Private AI Cloud, leveraging NVIDIA's CUDA software solution.

Diversified Portfolio and Market Dominance: Broadcom's transformation from a hardware-centric to a balanced hardware-software entity underscores its expansive portfolio, encompassing essential components in daily tech use. The fact that 99.9% of internet traffic interacts with at least one Broadcom chip underpins its market dominance and signifies a substantial competitive moat.

Financial Health and Debt Analysis

Debt Concerns Post-Acquisition: The acquisition of VMware has escalated Broadcom's net debt to between $70 billion and $80 billion. Despite this increase aligning with Broadcom’s strategic M&A approach, it raises concerns, given that the company's net income reported last was $14 billion. However, considering VMware's expected contribution in 2024, the debt-to-income ratio may become more favorable.

Divestiture and Free Cash Flow: Broadcom's plans to divest Carbon Black and EVC could potentially bring additional revenue, aiding in debt reduction. Furthermore, the company’s strong free cash flow (FCF) of $17 billion, even after adjusting for Stock-Based Compensation (SBC), provides a cushion for debt servicing, shareholder returns, and continued growth.

Investment and Shareholder Returns

ROIC and Capital Allocation: Broadcom has exhibited a remarkable Return on Invested Capital (ROIC) growth, reaching 22%. The company’s capital allocation strategies, including dividends and stock buybacks, have been predominantly shareholder-friendly, reflecting in its consistent dividend growth and EPS increase.

Future Earnings and Stock Performance: Looking ahead, EPS estimates indicate a 16% Compound Annual Growth Rate (CAGR) through October 2028. Such growth, combined with a balanced dividend policy, positions Broadcom as an attractive option for long-term investors, despite potential short-term volatility due to the large-scale VMware acquisition.

Market Risks and Strategic Challenges

Dependence on TSMC: Broadcom’s reliance on TSMC for 90% of its wafer production introduces a significant risk, given TSMC's market power and pricing leverage.

M&A-Driven Growth Strategy: Broadcom's growth heavily depends on its M&A strategy. Future acquisitions must be strategically sound to sustain growth, especially in the face of potential antitrust hurdles.

Leadership Transition Concerns: The future retirement of CEO Hock Tan, pivotal in Broadcom's success, may bring uncertainties regarding continued strategic direction and performance.

Conclusion: Assessing Broadcom's Future

Broadcom Inc. (NASDAQ: AVGO) stands at a critical juncture, balancing ambitious growth strategies with financial prudence. The VMware acquisition heralds a significant shift in its business model, promising diversification and reduced customer dependency. However, the increased debt and the challenges of integrating such a large-scale acquisition warrant careful monitoring.

For real-time insights and further analysis on Broadcom's stock performance, investors can refer to Broadcom Stock Real Time Chart. Additionally, for detailed information on insider transactions and stock profiles, visit Broadcom Insider Transactions and Broadcom Stock Profile.

Read More

-

AMLP ETF (NYSEARCA:AMLP): 8.29% Yield From America’s Midstream Toll Roads

06.01.2026 · TradingNEWS ArchiveStocks

-

XRP ETF Inflows Lift XRPI to $13.12 and XRPR to $18.57 as XRP-USD Price Targets $2.40+

06.01.2026 · TradingNEWS ArchiveCrypto

-

Natural Gas Price Forecast - NG=F Breaks Down as Henry Hub Spot Hits $2.86 and NG=F Slips Toward $3.00

06.01.2026 · TradingNEWS ArchiveCommodities

-

USD/JPY Price Forecast - USDJPY=X Holds 156.70 While Markets Weigh Softer NFP Risk Against a Hawkish BoJ

06.01.2026 · TradingNEWS ArchiveForex