Comprehensive Analysis: Ford, GM, and Honda in the Automotive Industry

Unveiling the Financial Dynamics and Future Outlook of Leading Automotive Giants Ford, General Motors, and Honda Amidst the EV Revolution | That's TradingNEWS

In-Depth Analysis of Ford (NASDAQ:F), General Motors (NYSE:GM), and Honda (NYSE:HMC)

Overview: Positioning in a Transforming Industry

The auto industry, marked by rapid technological changes and evolving market demands, presents a complex landscape for Ford (NASDAQ:F), General Motors (NYSE:GM), and Honda (NYSE:HMC). This analysis assesses their financial and operational performance with a focus on key metrics.

Ford Motor Company (NASDAQ:F): A Detailed Financial Review

- Operational Resilience: Ford's recent performance shows a significant operational turnaround. The company reported a 17% Y/Y increase in Q3 EBIT for Ford Blue, driven by strong sales in gas and hybrid versions of the 2024 F-150 pickup. Hybrid sales alone jumped 40% in Q3.

- Market Valuation Challenges: Despite an attractive P/E GAAP TTM ratio of around 8, Ford faces valuation challenges with a PEG Non-GAAP FWD ratio of 7.8, highlighting long-term earnings growth concerns.

- Financial Health: Ford’s balance sheet shows an equity-to-asset ratio of 0.17 and 83.48% of assets balanced by liabilities, indicating significant financial leverage. The company’s debt management strategy needs close monitoring.

- Investment Potential: DCF analysis suggests a possible undervaluation of 50%, but a more conservative estimate aligns Ford's fair value closer to $19, indicating a potential 40% upside.

General Motors (NYSE:GM): Financial Engineering and Market Response

- Stock Performance Post Financial Engineering: Following a $10B ASR program and a 33% dividend hike, GM's stock rose to $34.83 from $28.85, but market cap remained steady at around $39.5B, reflecting investor skepticism.

- Q4 2023 Expectations: GM is projected to report a Q4 EPS of $1.13 on revenues of $39.25B. However, Q4 vehicle deliveries indicate only a marginal growth of 0.3% Y/Y, with notable declines in key brands like Cadillac and Chevrolet.

- 2024 Sales Forecast: With a projection of 16M vehicle sales in the US, GM’s forecast remains optimistic amidst potential economic downturns.

- Valuation Insights: GM’s stock is trading at an attractive forward P/E of approximately 4.5x. However, our valuation model suggests a fair value of around $35 per share, falling short of the 15% long-term growth threshold.

Honda Motor Co., Ltd. (NYSE:HMC): Financial Stability and Strategic Moves

- Navigating Market Challenges: Honda faces lower-than-expected revenues but finds strength in its diverse business model and significant deals in the EV sector.

- Geographic Reach and Revenue Diversification: Honda's revenue distribution is heavily influenced by its strong presence in Asian markets, contributing to its resilience in challenging economic environments.

- Debt and Liquidity: As of September 30, 2023, Honda reported a healthy current ratio above 2x with substantial cash reserves. However, its financial debt/EBITDA ratio of approximately 4x, while an improvement from 2021, indicates areas for further financial prudence.

- Electrification and Market Prospects: Honda’s active role in the EV market, including new ventures like ChargeScape, positions it favorably in a sector expected to grow at a 19% CAGR until 2027.

Competitive Dynamics in EV Adoption

-

Ford & GM's EV Market Positioning: Both Ford and GM are intensively investing in the EV segment, yet they grapple with the challenge of transforming these investments into profitable ventures. Ford's launch of the all-electric F-150 Lightning and Mustang Mach-E, alongside GM's Chevy Bolt EV and upcoming electric models, signify their commitment to electrification. However, the high costs of R&D and production, coupled with market competition, are pressuring their profitability margins in this sector.

-

Honda's Strategic Edge in EV Transition: Honda's approach to EV transition appears more measured yet effective. With its recent partnerships and R&D focus, Honda is poised to leverage its existing market strengths, particularly in Asia, to make significant inroads into the EV market. The company's strategic collaboration and investment in new technologies indicate a readiness to capture the evolving EV demand effectively.

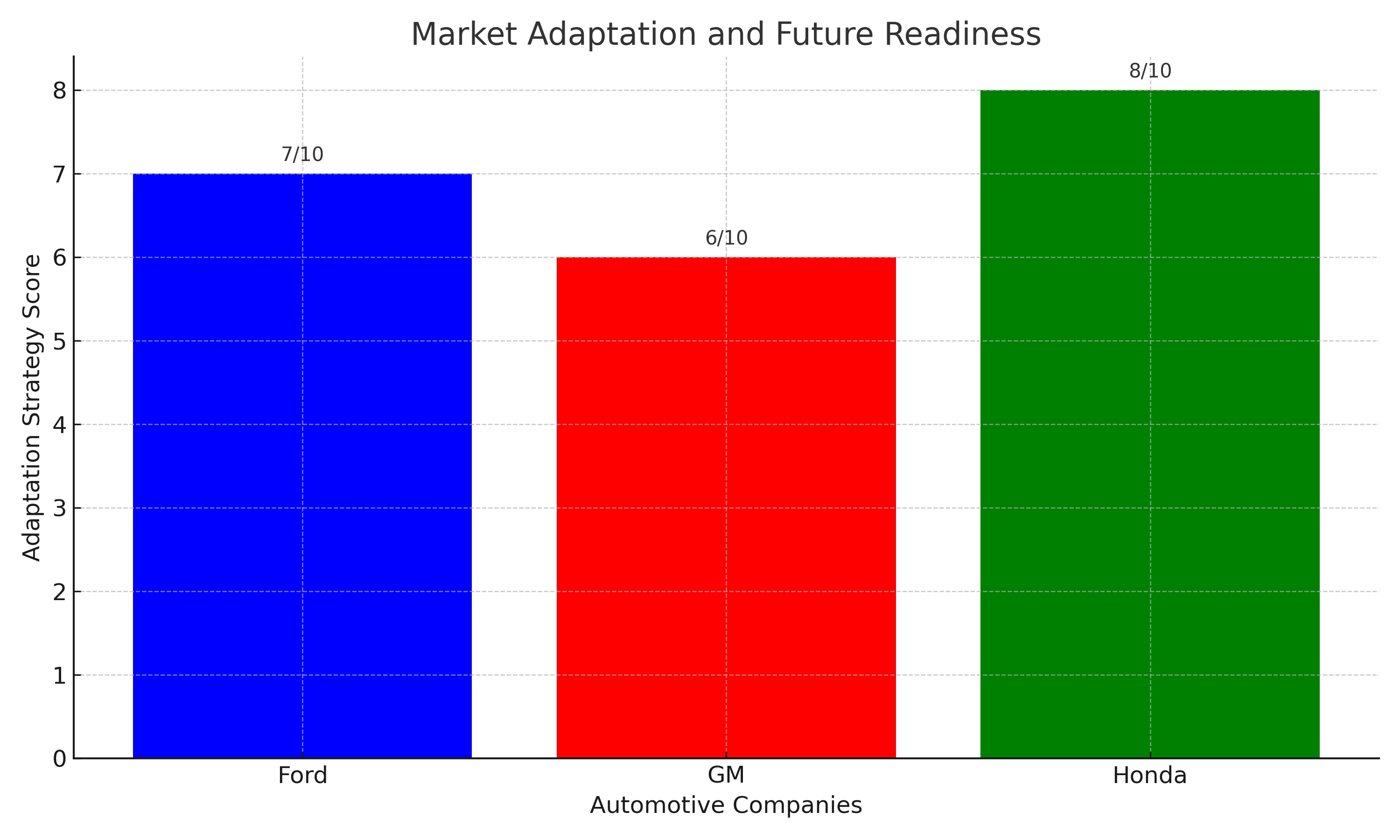

Market Adaptation and Future Readiness

-

Ford and GM's Adaptation Strategies: In addition to EV investments, Ford and GM are exploring new revenue streams such as software-enabled services and autonomous driving technologies. These initiatives are pivotal for future profitability but require substantial upfront investments and present execution risks.

-

Honda's Diversification and Innovation: Honda's strength lies in its diversified portfolio, including motorcycles, automobiles, and power products. This diversification, coupled with targeted investments in electrification and emerging markets, provides a solid foundation for Honda to navigate future market shifts more fluidly than its American counterparts.

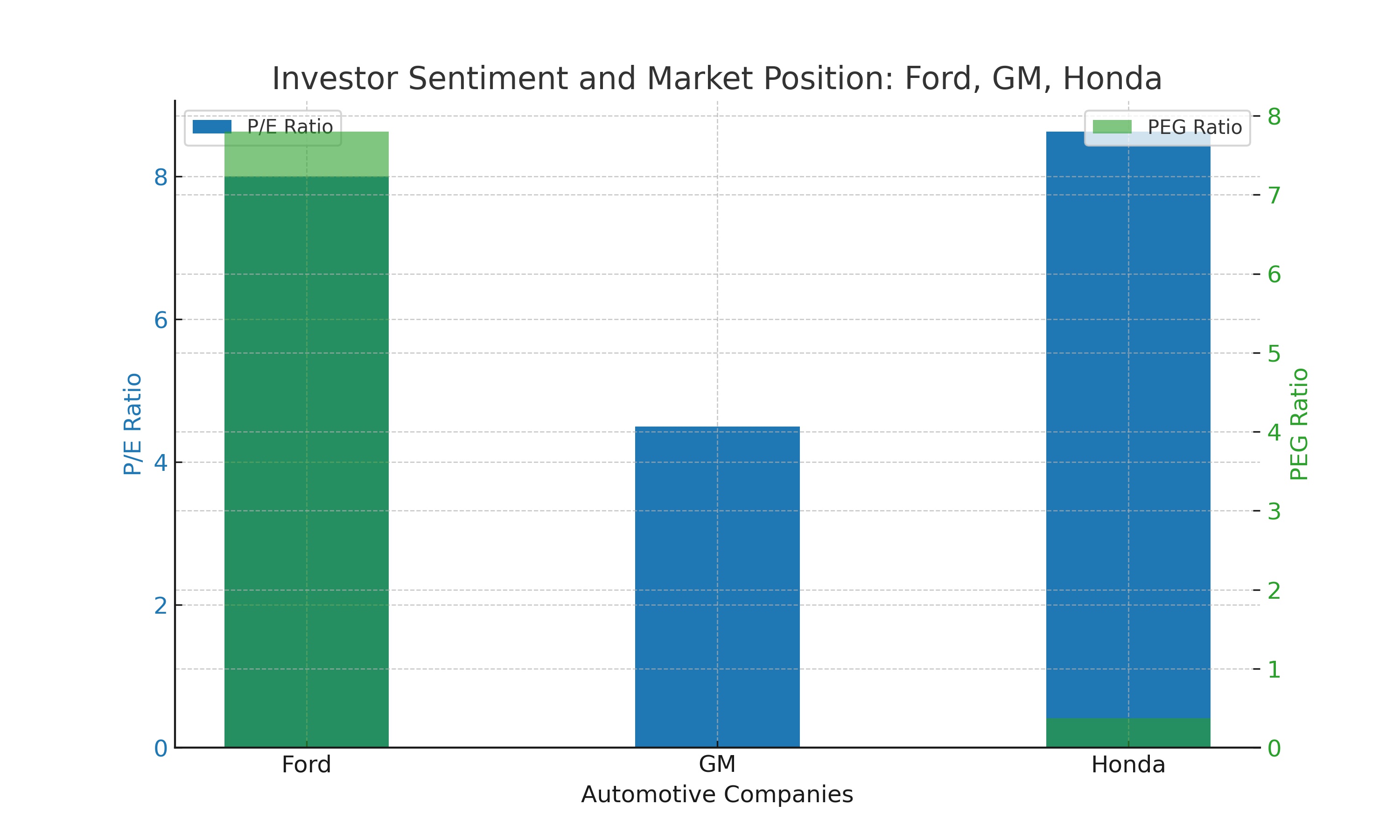

Investor Sentiment and Market Position: A Detailed Analysis

The current investor sentiment towards Ford (NASDAQ:F) and General Motors (NYSE:GM) leans towards caution. This perspective is largely influenced by the challenges both companies face in their transition to electric vehicles (EVs), as well as their ability to sustain profitability during this transformative phase.

Ford's Stock Dynamics:

- Ford's P/E GAAP TTM ratio, standing at around 8, reflects a market view of potential undervaluation. However, the higher PEG Non-GAAP FWD ratio of 7.8 raises concerns about the long-term growth prospects.

- Ford's stock has witnessed volatility, with its market capitalization fluctuating in response to its EV development updates and financial reports.

- The company's ambitious targets, such as producing 2 million EVs annually by 2026, have been met with mixed responses, affecting investor confidence.

General Motors' Market Perception:

- GM's forward P/E ratio of approximately 4.5x suggests an attractive investment on earnings basis. However, its stock market response post the $10B ASR program and a 33% dividend hike has been tepid, indicating investor skepticism.

- GM’s 2024 forecast of maintaining 16M vehicle sales in the US, consistent with 2023 levels, is viewed optimistically, yet the potential economic downturns pose significant risk to these projections.

- Investor apprehension is also evident in GM's approach to EVs, where despite notable launches like the Chevy Bolt EV, profitability per unit remains a concern.

Honda’s Stronger Position:

- Honda (NYSE:HMC), with its robust presence in Asian markets and strategic investments in the EV sector, appears to instill more confidence among investors.

- Honda's P/E ratio of 8.63 and a P/E/G ratio of 0.37, as of September 30, 2023, suggest an undervalued position relative to its potential growth in the EV sector.

- Honda's financial health, characterized by a healthy current ratio above 2x and a stable financial debt/EBITDA ratio of approximately 4x, adds to investor confidence.

- The company’s strategic initiatives like the development of ChargeScape and the Electrification Business Development Operations align well with the growing EV market, especially in Asia, offering a promising outlook.

Insider Transactions and Stock Performance

- Insider Activity Insights: Insider transactions can provide valuable insights into company leadership’s confidence in their strategies. For detailed insights into insider transactions and stock performance, visit:

Conclusion: Navigating a Transforming Landscape

-

Ford, GM, and Honda's Distinct Trajectories: Each company exhibits unique strengths and faces distinct challenges. Ford’s operational robustness is balanced by valuation and profitability concerns in the EV sector. GM’s aggressive financial engineering has yet to fully resonate with market confidence, while Honda’s strategic positioning and market diversification offer a more optimistic outlook.

-

Strategic Management of EV Transition: The transition to electric vehicles is a crucial phase for these automotive giants. Their ability to strategically manage this transition while adapting to market dynamics and technological advancements will be critical to their long-term success.

-

Investment Considerations: Potential investors should weigh these factors, including the detailed financial metrics, market positions, and insider transaction insights, when evaluating the investment potential of Ford, GM, and Honda. The rapidly evolving automotive industry, with its shift towards electrification and digitalization, requires a nuanced understanding of each company's strategies, market presence, and innovation capabilities.

Investors are encouraged to consider the broader industry trends, regulatory environment, and technological advancements as they assess the future growth potential and risks associated with Ford, GM, and Honda.

Read More

-

Google Stock Price Forecast - AI Capex Shock, Cloud Breakout and What $313 Really Prices In

12.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Between $1.34 Support And $1.50 Ceiling

12.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Around $63 And Brent $68 Trapped Between Oversupply And Gulf Risk

12.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones Holds 50,000 While S&P 500 Steadies and Nasdaq Sinks on Cisco & AppLovin Rout, CPI Looms

12.02.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - GBPUSD=X Stalls Around 1.3630 as Weak UK GDP Meets Robust US Jobs Data

12.02.2026 · TradingNEWS ArchiveForex