Financial Review of Fidelity National Information Services NYSE:FIS

From Market Challenges to Insider Optimism: Unveiling FIS's Strategic Path and Investment Potential | That's TradingNEWS

Financial Analysis of Fidelity National Information Services (NYSE:FIS)

Introduction

In the fast-evolving financial technology sector, Fidelity National Information Services, Inc. (NYSE:FIS) presents a compelling case of resilience and strategic recalibration. Despite a challenging market environment, FIS's recent maneuvers and financial health offer insights into its potential for recovery and growth. This analysis delves into the numerical heart of FIS's performance, strategic decisions, and their implications for investors.

Financial Performance Overview

NYSE:FIS: An Investor's Glimpse

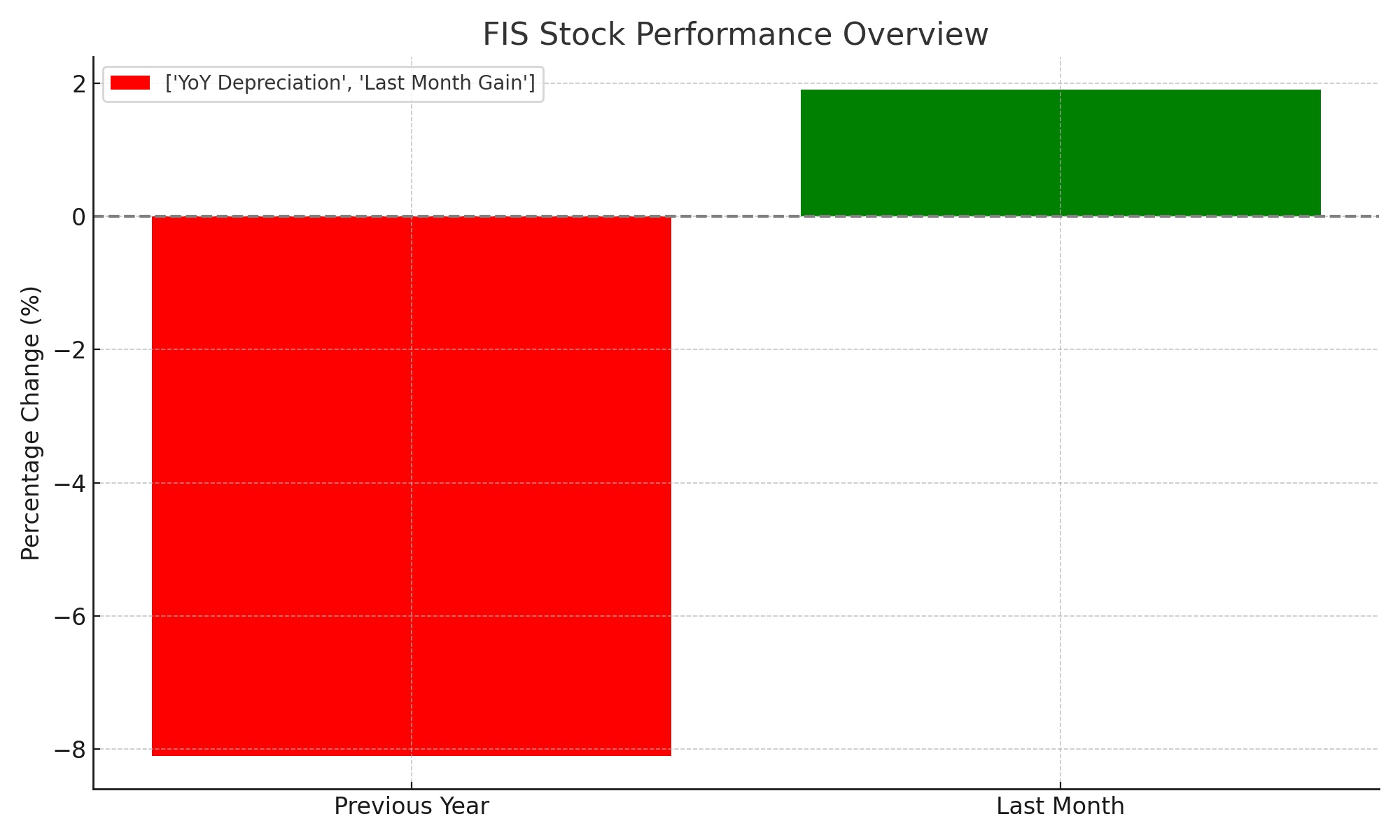

Closing at $62.32 on February 12, 2024, FIS exhibited a 1.90% gain over the preceding month, albeit a concerning 8.10% depreciation year-over-year. With a market capitalization of $36.924 billion, the company's valuation reflects both its scale and the market's cautious stance regarding its future.

Revenue and Profitability Insights

From Losses to Profits: A Turbulent Journey

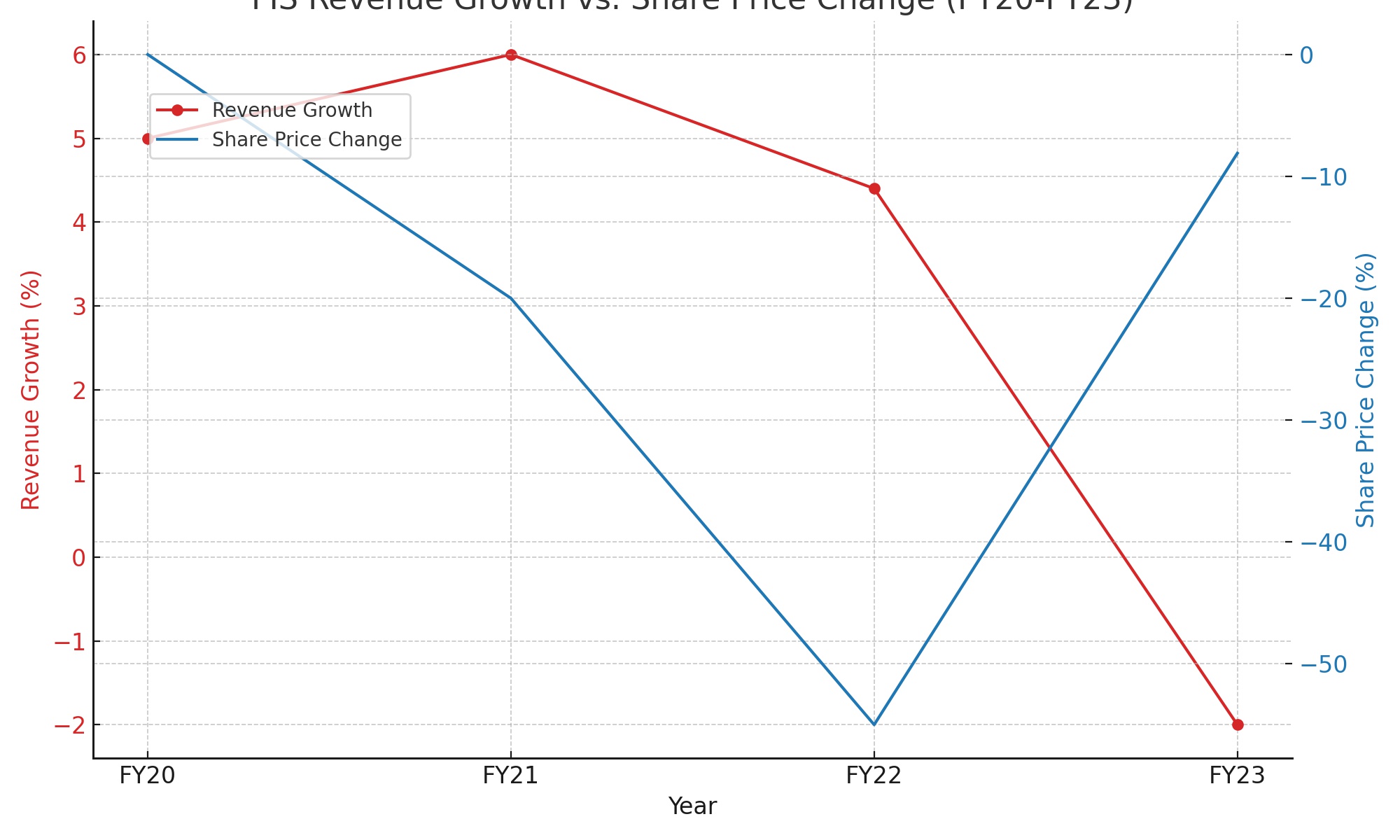

FIS's transition from losses to profitability over the past five years marks a significant turnaround. Despite this progress, the company faced a recent setback with a reported loss, underscoring the volatile nature of its earnings. Revenue growth stands at 4.4% over the past three years, a figure that contrasts sharply with a 55% decline in share price over the same period.

Insider Moves Versus Market Sentiment: A Closer Look at FIS

In the volatile domain of stock investments, insider transactions serve as a compelling barometer of a company's future prospects. For Fidelity National Information Services, Inc. (NYSE:FIS), a distinct surge in insider buying activities emerges as a beacon of optimism amidst a backdrop of market skepticism. This trend is particularly pronounced, considering FIS's recent stock performance, with a year-over-year decline of 8.10% and a slight 1.90% uptick over the last month, culminating in a closing price of $62.32 as of February 12, 2024.

Strategic Shifts and Their Market Impact

Analyzing Dividends and Shareholder Returns

Despite FIS's efforts to reward shareholders through dividends, the total shareholder return (TSR) of -51% over three years paints a stark picture of the challenges in delivering sustained value.

Earnings Projections and Market Sentiment

With an anticipated EPS of $0.96 for the upcoming quarter, reflecting a 43.86% decrease year-over-year, and a projected revenue decline of 32.04% to $2.52 billion, the market awaits signs of stabilization and growth.

Detailed Financial Analysis

Debt, Liquidity, and Solvency: A Critical Examination

FIS's financial structure reveals a contrast between its manageable debt-to-equity ratio of 0.32 and liquidity concerns, highlighted by a current ratio falling below 1. This discrepancy underscores the importance of strategic financial management in the coming periods.

Operational Efficiency and Competitive Edge

The company's operational metrics, including ROA and ROE, have suffered due to significant non-cash charges, reflecting challenges in asset and equity efficiency. Furthermore, FIS's competitive positioning, as evidenced by its return on total capital (ROTC), suggests room for improvement in leveraging its market position and financial resources.

Future Revenue Streams and Valuation Considerations

The strategic decision to spin off certain segments is anticipated to result in a 33% revenue drop. However, this move could potentially streamline operations and focus on more profitable areas, setting the stage for a more focused growth strategy.

Forward-Looking Perspectives

Valuation and Investment Thesis

A conservative valuation approach, factoring in the anticipated 32% revenue decline and modest top-line growth projections of 2-3% for the remaining segments, suggests a cautious investment stance. With a calculated intrinsic value offering a significant margin of safety, FIS currently trades above this conservative fair value estimate, indicating potential overvaluation at current levels.

Strategic Imperatives and Market Watch

As FIS navigates its post-spin-off landscape, the focus on reducing debt, improving liquidity, and enhancing operational efficiency becomes paramount. The success of these strategic initiatives, alongside evolving market and economic conditions, will critically influence FIS's long-term value proposition.

Conclusion

Fidelity National Information Services (NYSE:FIS) stands at a pivotal juncture, with its financial and strategic decisions under the microscope. The detailed numerical analysis underscores the challenges FIS faces but also highlights potential pathways to recovery and growth. For investors, a nuanced understanding of FIS's financial health, market performance, and strategic direction is essential. Vigilance and a focus on forthcoming financial disclosures will be key in assessing the company's trajectory in the competitive fintech landscape. For ongoing updates and detailed financial information, interested parties are encouraged to visit TradingNews.com for real-time chart analysis and FIS's stock profile for insider transactions insights.

In navigating FIS's investment landscape, a balanced approach, emphasizing financial fundamentals and strategic outlook, will be crucial in discerning the company's potential for sustained recovery and growth.

That's TradingNEWS

Read More

-

Google Stock Price Forecast - AI Capex Shock, Cloud Breakout and What $313 Really Prices In

12.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Between $1.34 Support And $1.50 Ceiling

12.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Around $63 And Brent $68 Trapped Between Oversupply And Gulf Risk

12.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones Holds 50,000 While S&P 500 Steadies and Nasdaq Sinks on Cisco & AppLovin Rout, CPI Looms

12.02.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - GBPUSD=X Stalls Around 1.3630 as Weak UK GDP Meets Robust US Jobs Data

12.02.2026 · TradingNEWS ArchiveForex