Is Mastercard NYSE:MA a Buy ? Earnings Preview

Anticipating Q1 2024 Outcomes: Analyzing Mastercard’s Financial Health and Strategic Position Amidst Market Shifts and Competitive Dynamics | That's TradingNEWS

Mastercard (NYSE:MA) Earnings Preview: A Hold Strategy Ahead of Q1 2024 Report

Anticipating Mastercard's Q1 2024 Earnings

With the earnings report scheduled for May 1st, Mastercard stands at a pivotal juncture. Historically, this quarter has not been strong for the payment processor; however, Mastercard has consistently surpassed Wall Street's earnings expectations. This trend, coupled with resilient U.S. consumer spending, which saw a 0.8% increase in February—the largest gain since January 2023—suggests potential upside. This increase in consumer spending, critical as it accounts for a major part of the U.S. economy, directly boosts transaction volumes, benefiting Mastercard's revenue from interchange fees, its primary revenue source.

Financial Expectations and Sector Dynamics

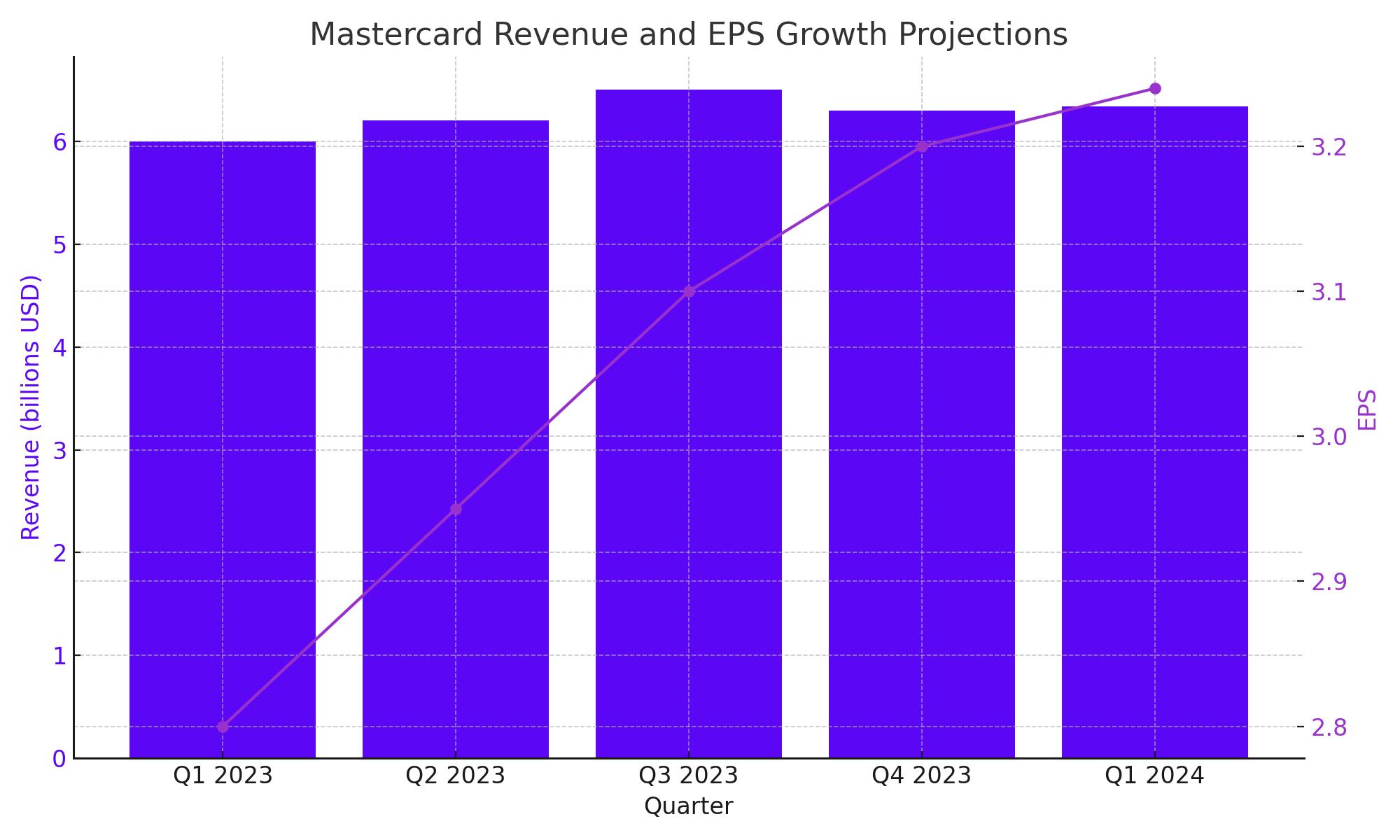

For Q1 2024, analysts project Mastercard’s earnings to rise, with an EPS estimate of $3.24, up from $2.80 year-over-year, and revenue expectations of $6.34 billion, marking a 10.36% increase from last year. These projections reflect an anticipated continuation of robust transaction processing volume due to increased consumer spending.

Regulatory Challenges and Competitive Risks Faced by Mastercard

Mastercard and its counterpart Visa are navigating stringent regulatory environments in the U.S. and Europe, where legislation to cap interchange fees poses a substantial impact. Specifically, the European Union's cap on interchange fees at 0.2% for debit cards and 0.3% for credit cards has set precedents that other regions are considering. In the U.S., recent class action settlements have required Visa and Mastercard to adjust their fee structures, potentially reducing their revenue from these fees by billions annually.

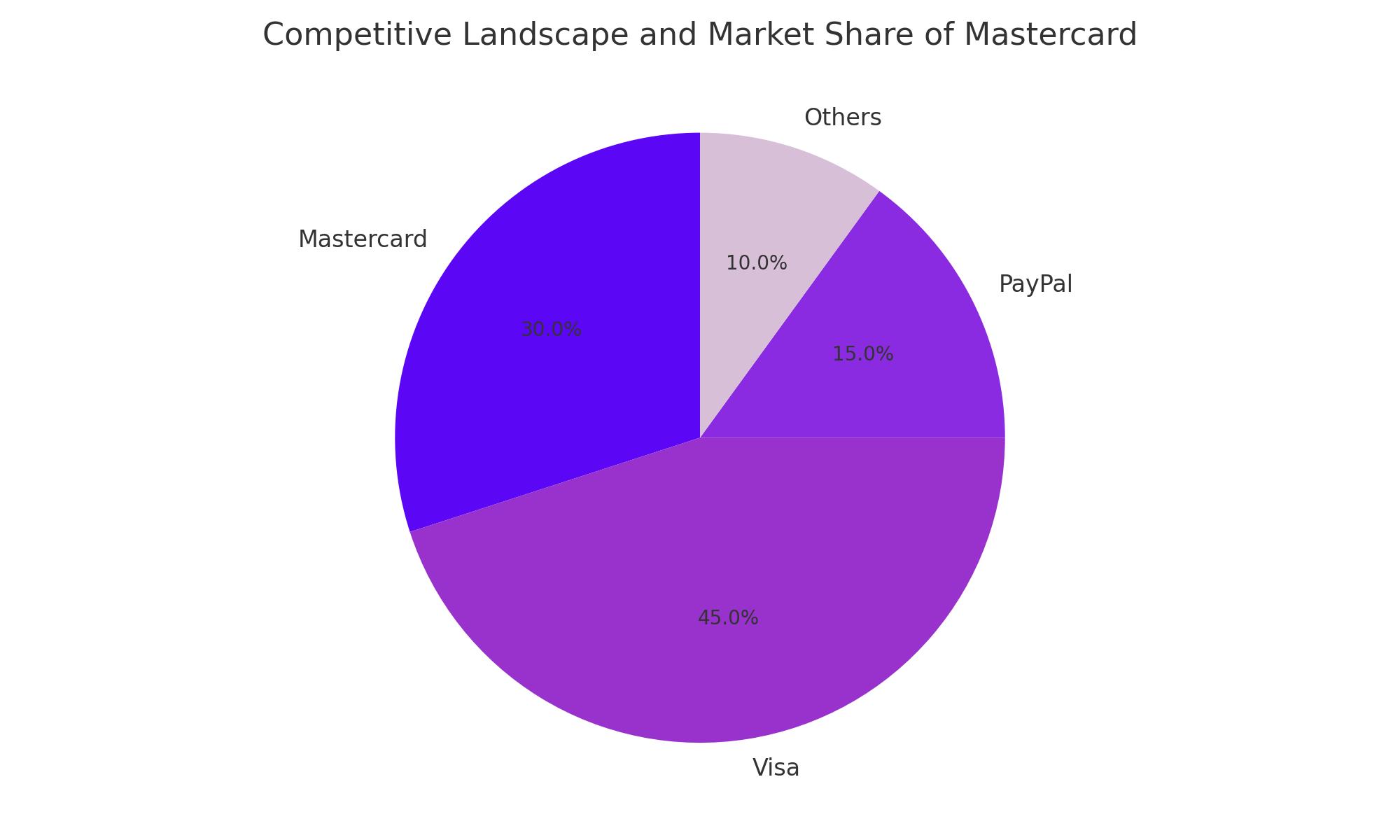

Moreover, the rise of fintech platforms like PayPal, which now offers expanded direct payment options, poses a direct threat to Mastercard's traditional revenue streams. PayPal's active account base has grown to over 400 million users globally, increasingly diverting transaction volumes away from Mastercard's network.

Impact of Capital One's Acquisition of Discover on Mastercard

Mastercard's upcoming earnings call is set to address significant industry shifts, particularly the ramifications of Capital One's acquisition of Discover Financial Services. This transaction, valued at $35.3 billion, marks a substantial consolidation within the payment processing industry. Analysts predict that this deal could reshape competitive dynamics, potentially impacting Mastercard's market strategy and positioning, especially in terms of network volume and fee structures.

Operational Highlights: Mastercard's Q1 2024 Performance Projections

Mastercard's CFO, Sachin Mehra, highlighted during a March 2024 financial symposium that while there remains strong demand for the company’s value-added services, Q1 2024 is expected to see moderated growth in this sector. Mehra attributed this forecasted slowdown to high base effects, as Q1 2023 experienced particularly strong growth in these services. This year-over-year comparison suggests a tempering of expectations for the upcoming earnings period.

Market Position and Financial Outlook for Mastercard

Mastercard continues to hold a formidable market position, sharing a duopoly with Visa in the payment processing sector. For Q1 2024, analysts project Mastercard's earnings per share (EPS) to increase by 15.7% to $3.24, up from $2.80 in the same quarter the previous year. Revenue is also expected to rise by 10.36% year-over-year, reaching approximately $6.34 billion. These projections reflect confidence in Mastercard’s extensive global network and its ongoing initiatives in digital payment innovations and cybersecurity enhancements, despite facing regulatory pressures and increasing competition from fintech platforms like PayPal, which are diversifying payment methodologies away from traditional card-based transactions.

That's TradingNEWS

Read More

-

Google Stock Price Forecast - AI Capex Shock, Cloud Breakout and What $313 Really Prices In

12.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Between $1.34 Support And $1.50 Ceiling

12.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Around $63 And Brent $68 Trapped Between Oversupply And Gulf Risk

12.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones Holds 50,000 While S&P 500 Steadies and Nasdaq Sinks on Cisco & AppLovin Rout, CPI Looms

12.02.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - GBPUSD=X Stalls Around 1.3630 as Weak UK GDP Meets Robust US Jobs Data

12.02.2026 · TradingNEWS ArchiveForex