Stock Outperforms in Q1 - Is NASDAQ:ISRG a Buy ?

Unpacking Intuitive Surgical's Latest Financials: Revenue Surge and Strategic Advancements Set the Stage for Continued Growth | That's TradingNEWS

NASDAQ:ISRG Detailed Overview

Intuitive Surgical, Inc. (NASDAQ:ISRG)

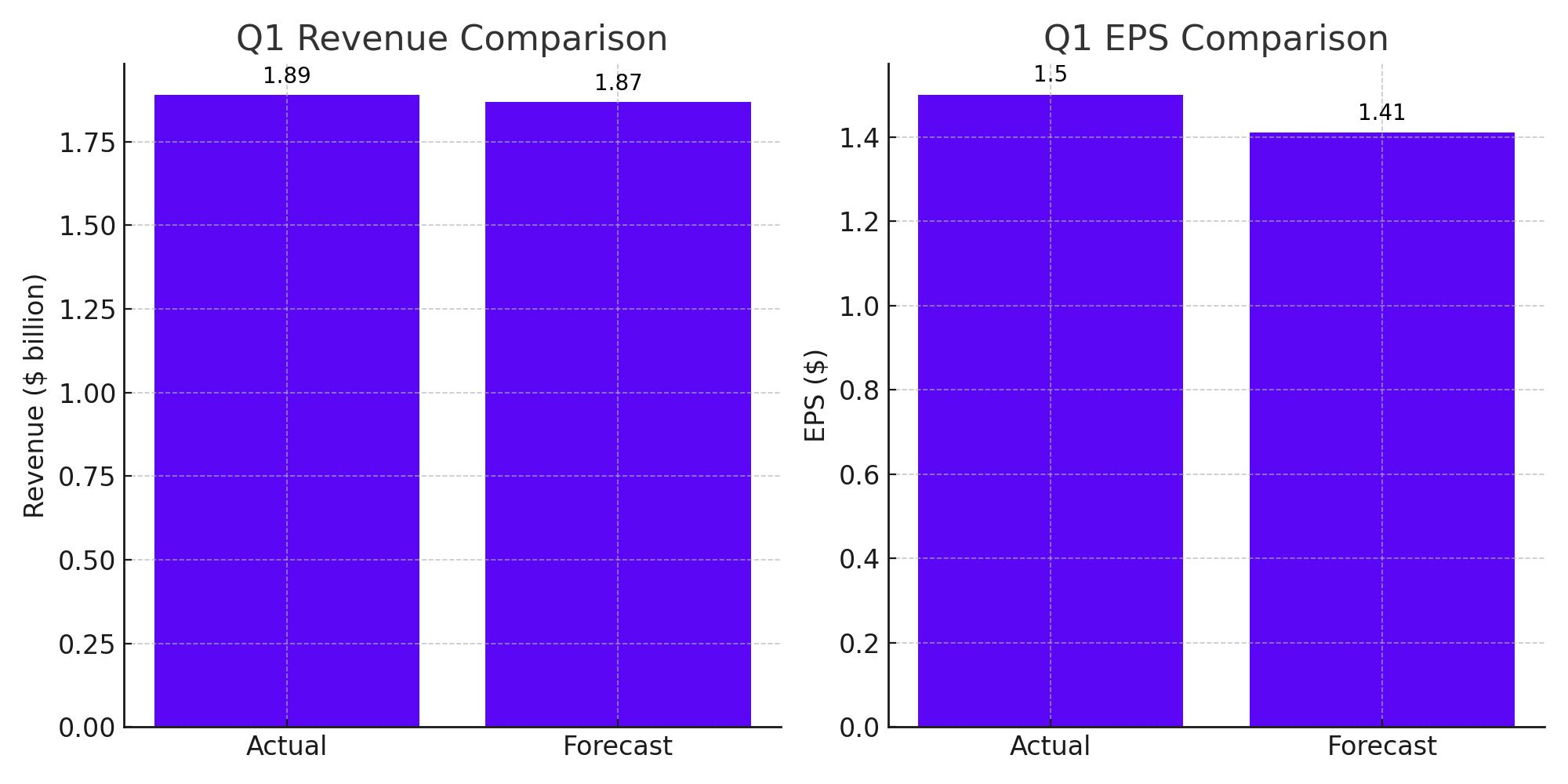

has announced its first-quarter earnings, showcasing results that not only topped analyst forecasts but also signaled strong operational execution. For Q1, the company posted revenues of $1.89 billion, which was ahead of the consensus estimate of $1.87 billion by analysts surveyed by TradingNews. Adjusted earnings per share were $1.50, surpassing the expected $1.41. This performance underscores the company's successful strategic initiatives and solid market positioning, reflecting a broader acceptance and integration of its technological offerings in the surgical domain.

In-Depth Earnings Analysis and Key Revenue Catalysts

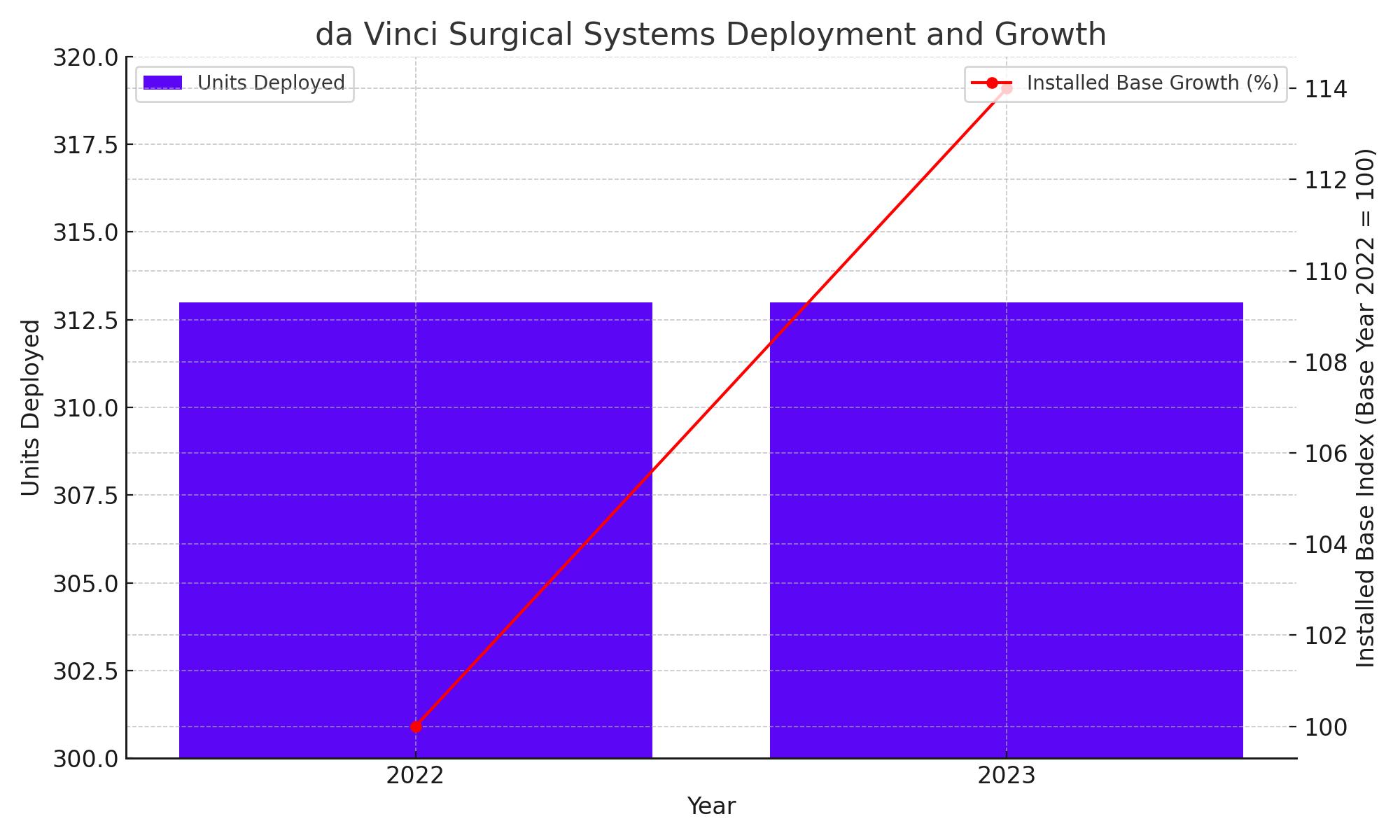

Intuitive Surgical's revenue boost can largely be attributed to the significant uptick in global procedures performed using its flagship da Vinci surgical systems. The company maintained its deployment at 313 units, mirroring the installation figures from the previous year, thus maintaining a steady growth trajectory in terms of unit placement. More impressively, the total installed base of these systems grew by 14% compared to March 2023, indicating robust demand and sustained market penetration. This growth is a direct reflection of the increasing acceptance of robotic-assisted surgeries across various medical disciplines worldwide.

Stock Performance and Investor Sentiment

Over the past three years, ISRG's stock has appreciated by 35%, indicating a strong market endorsement of its business model and future potential. This appreciation reflects a broader investor confidence, which has remained resilient despite the natural volatilities associated with the healthcare equipment sector. Currently, the stock is trading around $370, demonstrating the market's positive reception to the latest earnings and future prospects.

Valuation Metrics and Market Positioning

Intuitive Surgical's current price-to-sales ratio is approximately 18 times, aligning with its five-year historical average. This valuation metric highlights the market's willingness to pay a premium for the company's growth prospects, particularly in the innovative robotic surgical space. The recent FDA approval of the da Vinci 5 system in March 2024 further bolsters Intuitive Surgical’s competitive edge, potentially catalyzing future revenue streams and reinforcing its market leadership.

Strategic Growth Initiatives and Future Prospects

The launch of the da Vinci 5 system marks a significant milestone in Intuitive Surgical’s commitment to continuous innovation and market expansion. This new system represents the next generation in robotic-assisted surgery, featuring advanced capabilities that promise to enhance surgical precision and outcomes. With the robotic surgery market expected to expand to $14 billion by 2026, Intuitive Surgical is well-positioned to capitalize on this growth through increased system placements and enhanced procedural volumes.

Economic Challenges and Financial Stability

Despite a positive performance, Intuitive Surgical faces macroeconomic challenges such as high interest rates and potential fluctuations in healthcare spending. These factors could impact hospital budgets and, consequently, the capital available for new investments in surgical technologies. Nonetheless, Intuitive Surgical's strong financial position, characterized by $2.75 billion in cash and equivalents, provides a solid foundation to withstand these pressures. This financial resilience ensures the company can continue investing in growth opportunities without compromising its operational stability.

Insider Transactions and Market Sentiment

Intuitive Surgical, Inc. (NASDAQ:ISRG) has seen notable activity from insiders, primarily characterized by sales and no corresponding purchase transactions. Over the past twelve months, more than 500,000 shares have been sold by insiders, an action that could typically be interpreted as a lack of confidence by those closely associated with the company's operations. However, this interpretation needs to be balanced with broader market sentiment.

Despite the insider sales, institutional ownership remains robust, with major investment firms such as BlackRock and Vanguard not only maintaining their stakes but also increasing their positions. This trend underscores a strong endorsement from larger market players, suggesting a belief in the company’s long-term growth prospects despite short-term sell-offs by insiders. The substantial institutional holding, which stands at 81%, reflects a consensus of strong market confidence in Intuitive Surgical’s strategic direction and market position.

Investor Considerations and Risk Assessment

For investors considering Intuitive Surgical, it's essential to weigh the company's premium valuation, which as of the latest market data, places ISRG at a high price-to-earnings ratio. Such a valuation commands heightened scrutiny of the company's future earnings potential and market stability. Intuitive Surgical's forward trajectory will heavily depend on its ability to manage operational costs effectively while it continues to expand and integrate innovative technologies such as the new da Vinci 5 surgical systems.

That's TradingNEWS

Read More

-

Google Stock Price Forecast - AI Capex Shock, Cloud Breakout and What $313 Really Prices In

12.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Between $1.34 Support And $1.50 Ceiling

12.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Around $63 And Brent $68 Trapped Between Oversupply And Gulf Risk

12.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones Holds 50,000 While S&P 500 Steadies and Nasdaq Sinks on Cisco & AppLovin Rout, CPI Looms

12.02.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - GBPUSD=X Stalls Around 1.3630 as Weak UK GDP Meets Robust US Jobs Data

12.02.2026 · TradingNEWS ArchiveForex