Comprehensive Financial Analysis: Pinduoduo Inc. (NASDAQ: PDD)

Market Overview and Company Dynamics

Pinduoduo Inc. (NASDAQ: PDD), a notable player in the e-commerce sector, marks a significant presence on NasdaqGS. The company's market capitalization stands impressively at $191.955 billion, with a Beta of 0.63, indicating lower volatility compared to the broader market. PDD's stock price fluctuates within a 52-week range of $59.67 to $150.66, illustrating a dynamic investor engagement and market responsiveness.

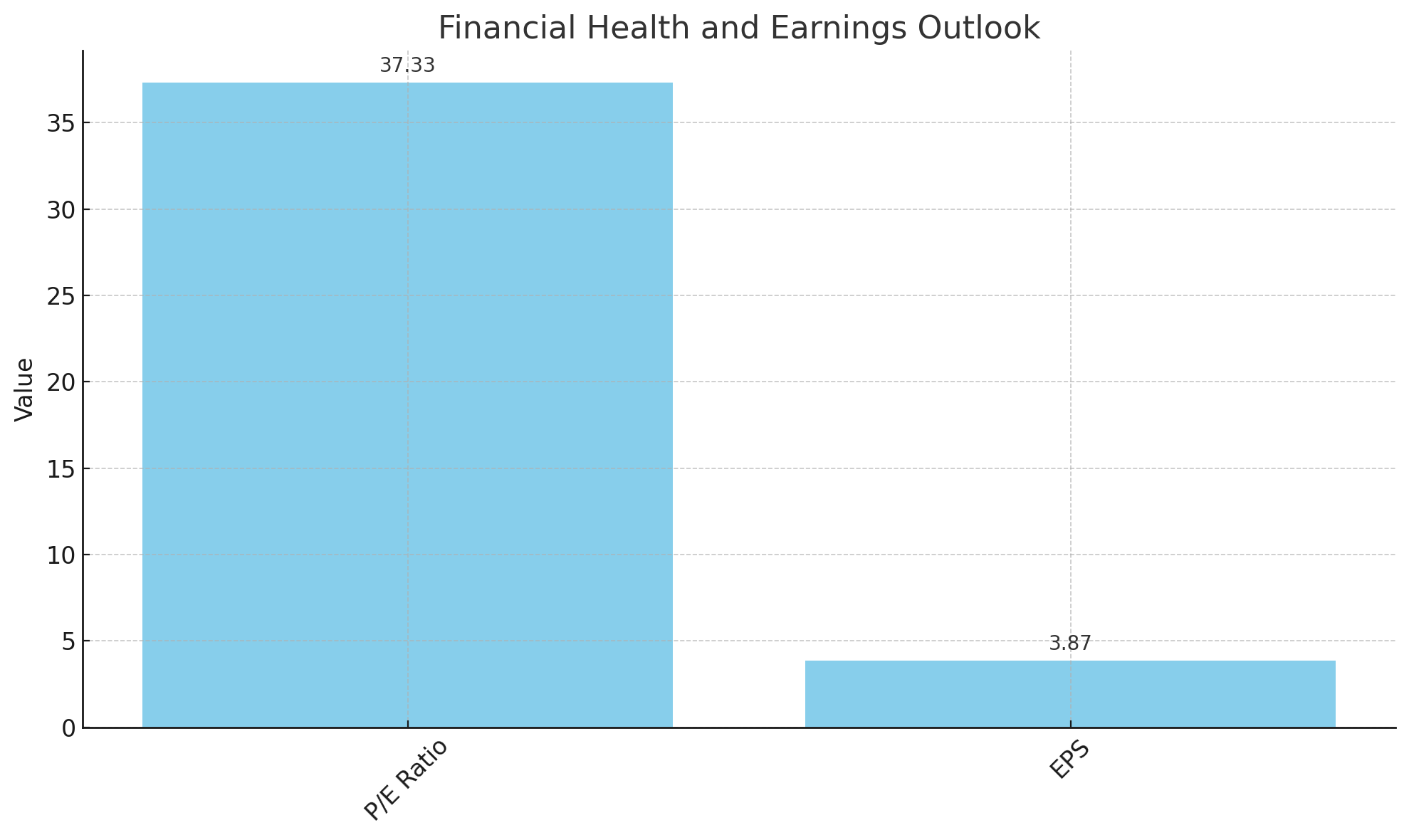

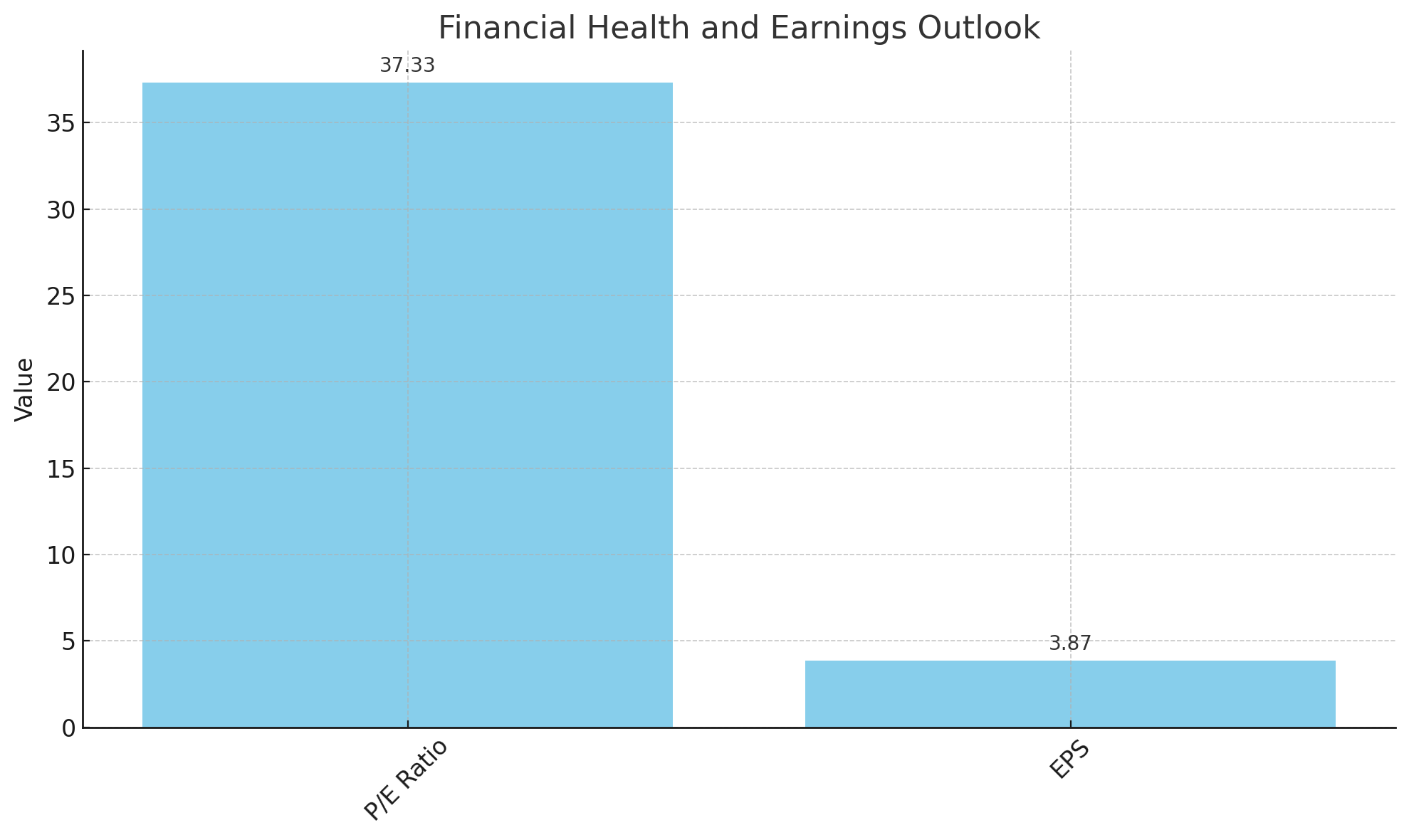

Financial Health and Earnings Outlook

Pinduoduo's financial health is robust, reflected in its trailing P/E ratio of 37.33 and an EPS of 3.87, signifying solid profitability amid market fluctuations. The anticipation for its earnings date between March 18 and March 22, 2024, is high among investors. PDD does not offer a dividend, focusing instead on reinvestment and growth.

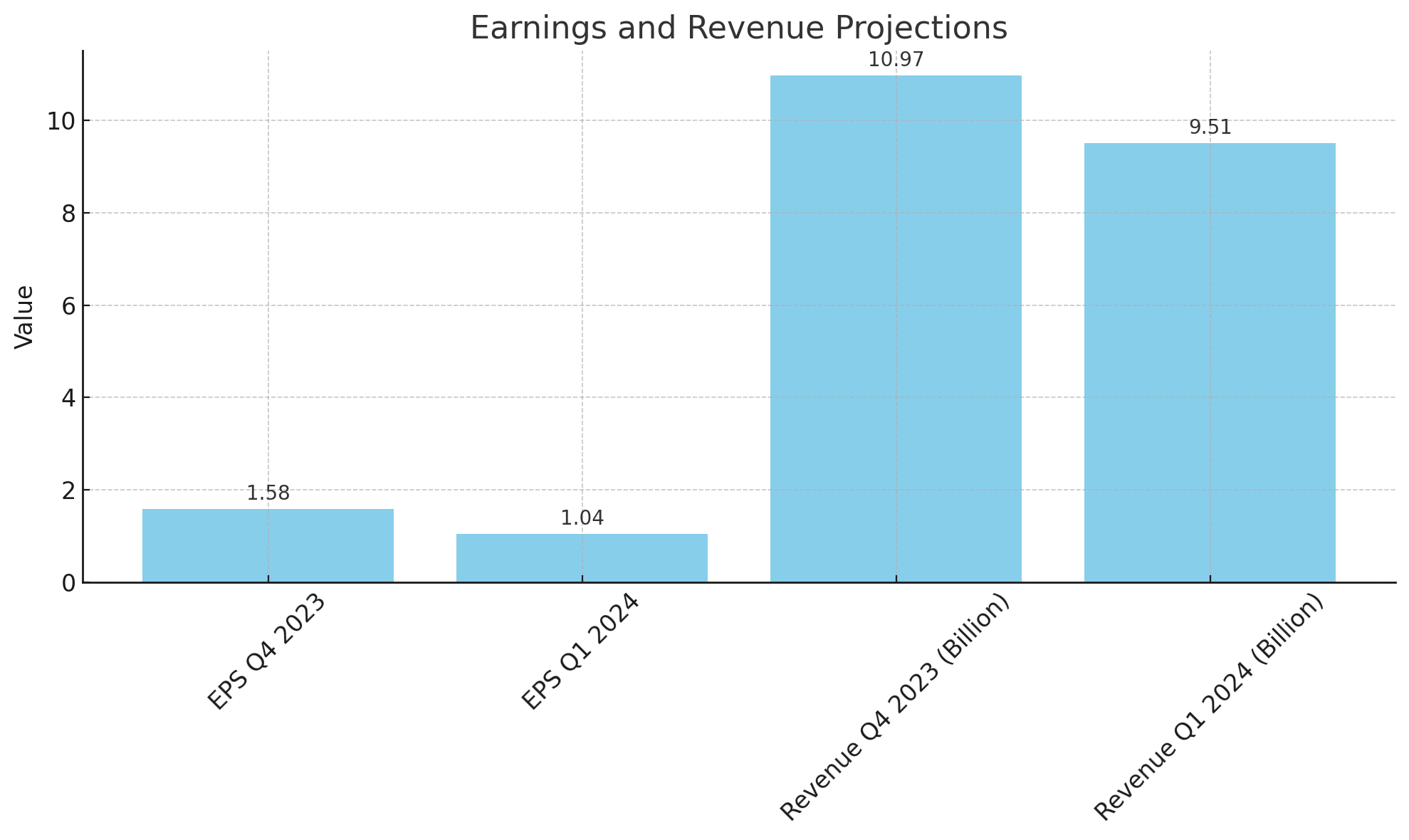

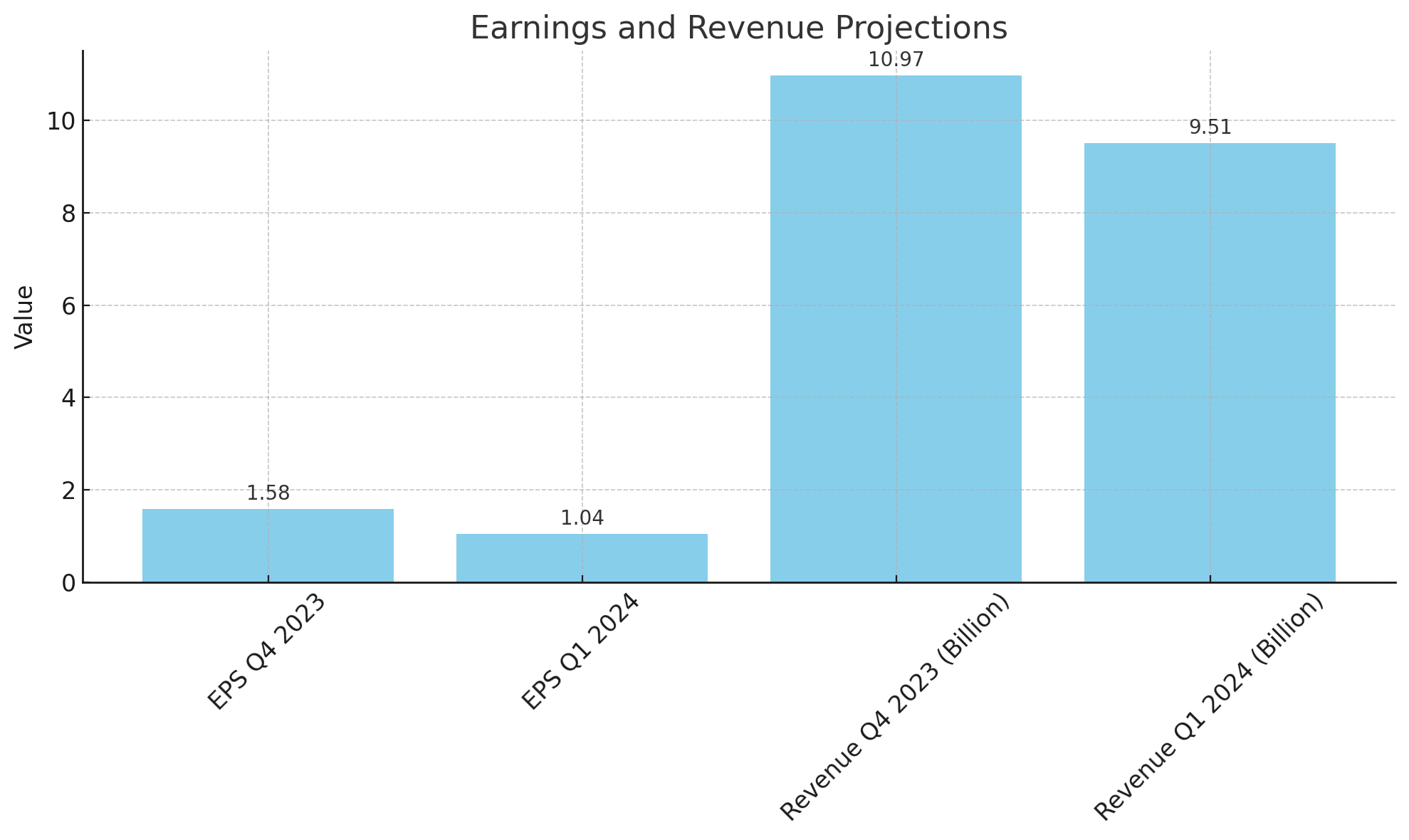

Earnings and Revenue Projections: A Detailed Analysis

For the quarter ending December 2023, analysts project an EPS of $1.58, with an expectation of $1.04 for the following quarter. These estimates indicate significant growth from the previous year's EPS. Revenue forecasts stand at $10.97 billion for the current quarter, expected to rise to $9.51 billion for the next quarter, showcasing robust year-over-year growth.

Institutional Investment Insights

Pinduoduo's stock shows a healthy mix of institutional trust, with a notable 28.74% held by institutions. This level of institutional investment underscores confidence in PDD's strategic direction and future growth prospects.

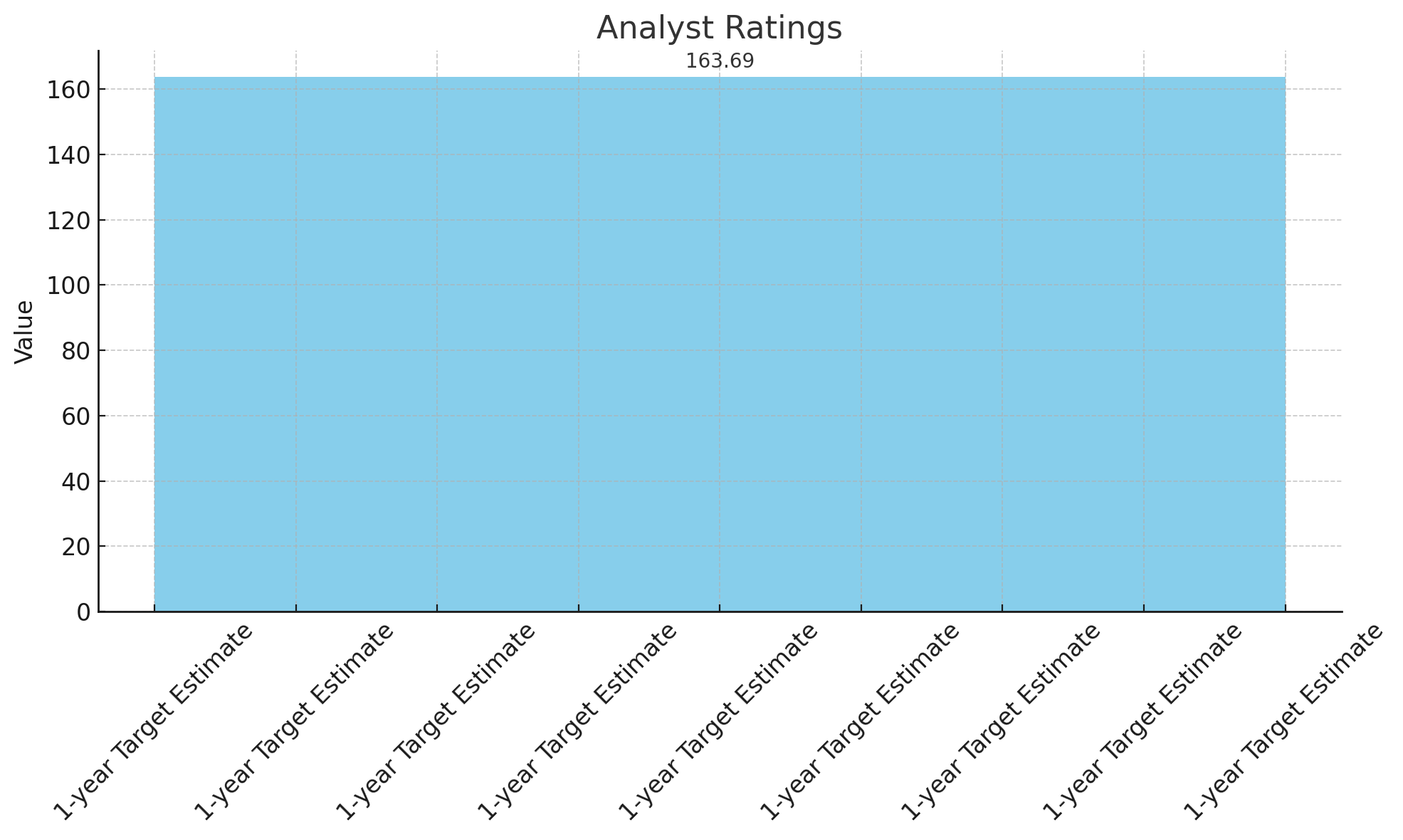

Analyst Ratings: Varied Perspectives

PDD enjoys diverse analyst ratings, reflecting the dynamic nature of the e-commerce sector. The 1-year target estimate for the stock is $163.69, indicating a bullish sentiment among market analysts.

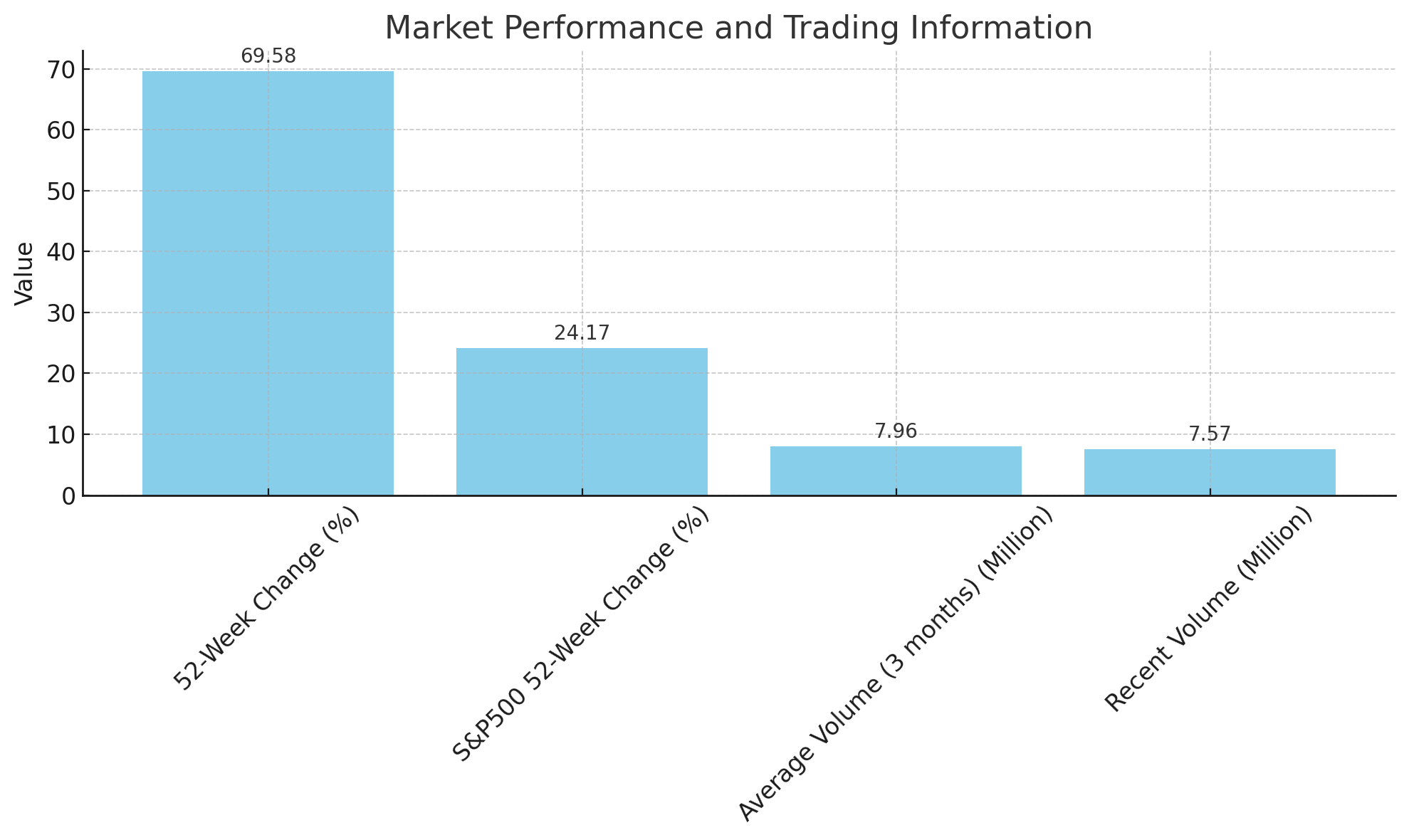

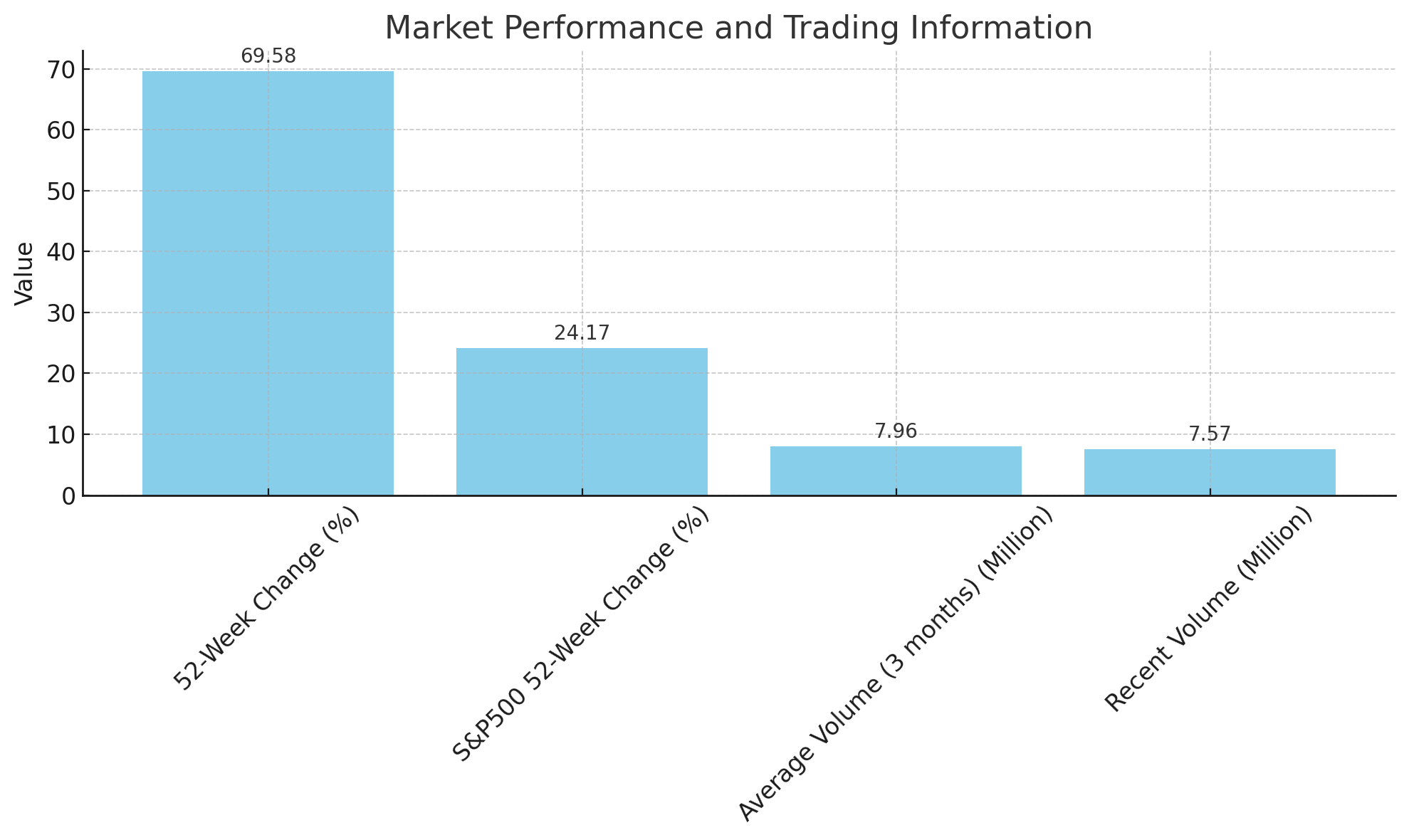

Market Performance and Trading Information

PDD's impressive 52-week change of 69.58% outperforms the S&P 500's 24.17% change, showcasing its strong market performance. The stock's average volume over three months stands at 7.96M, with a recent volume of 7,568,003, highlighting active trading.

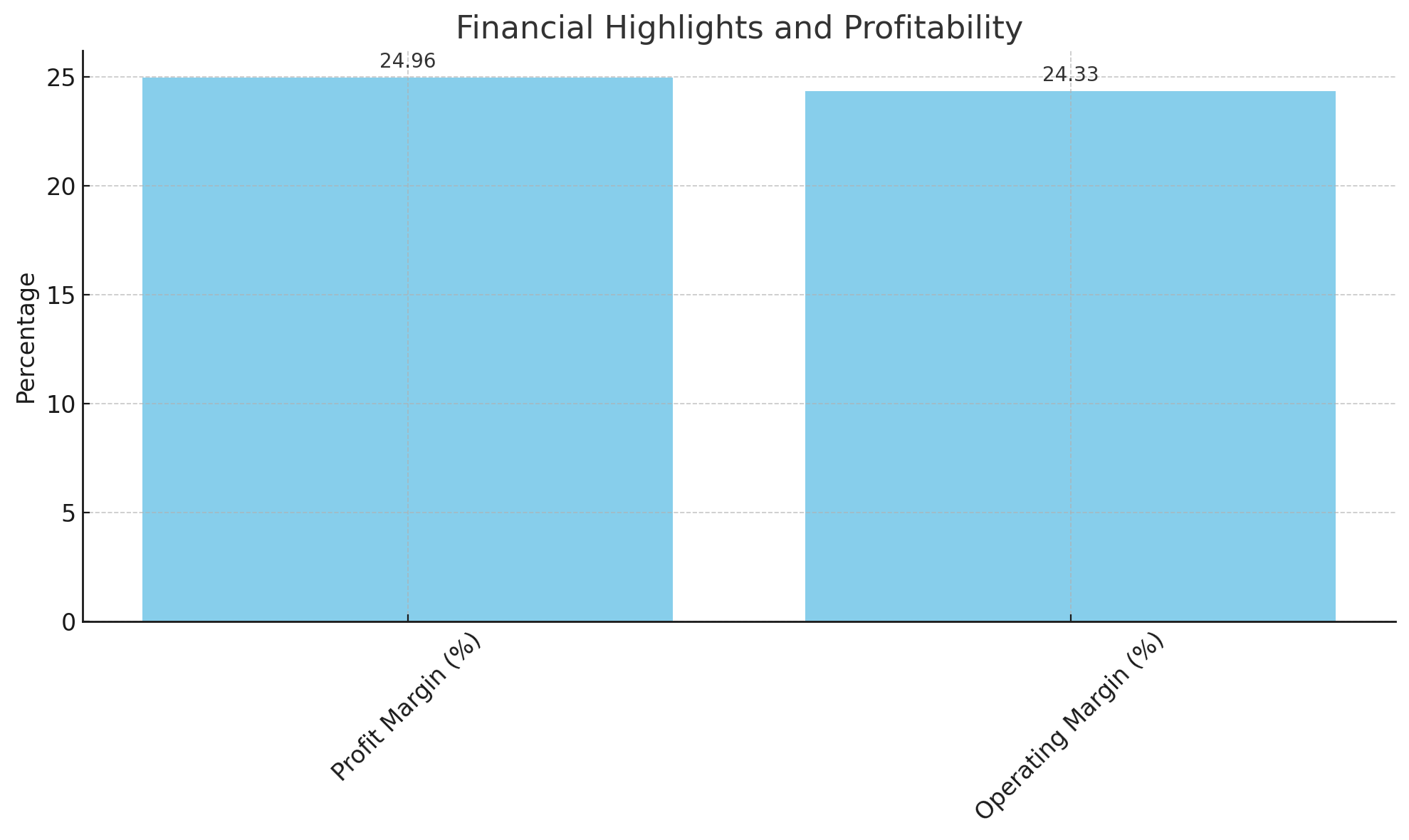

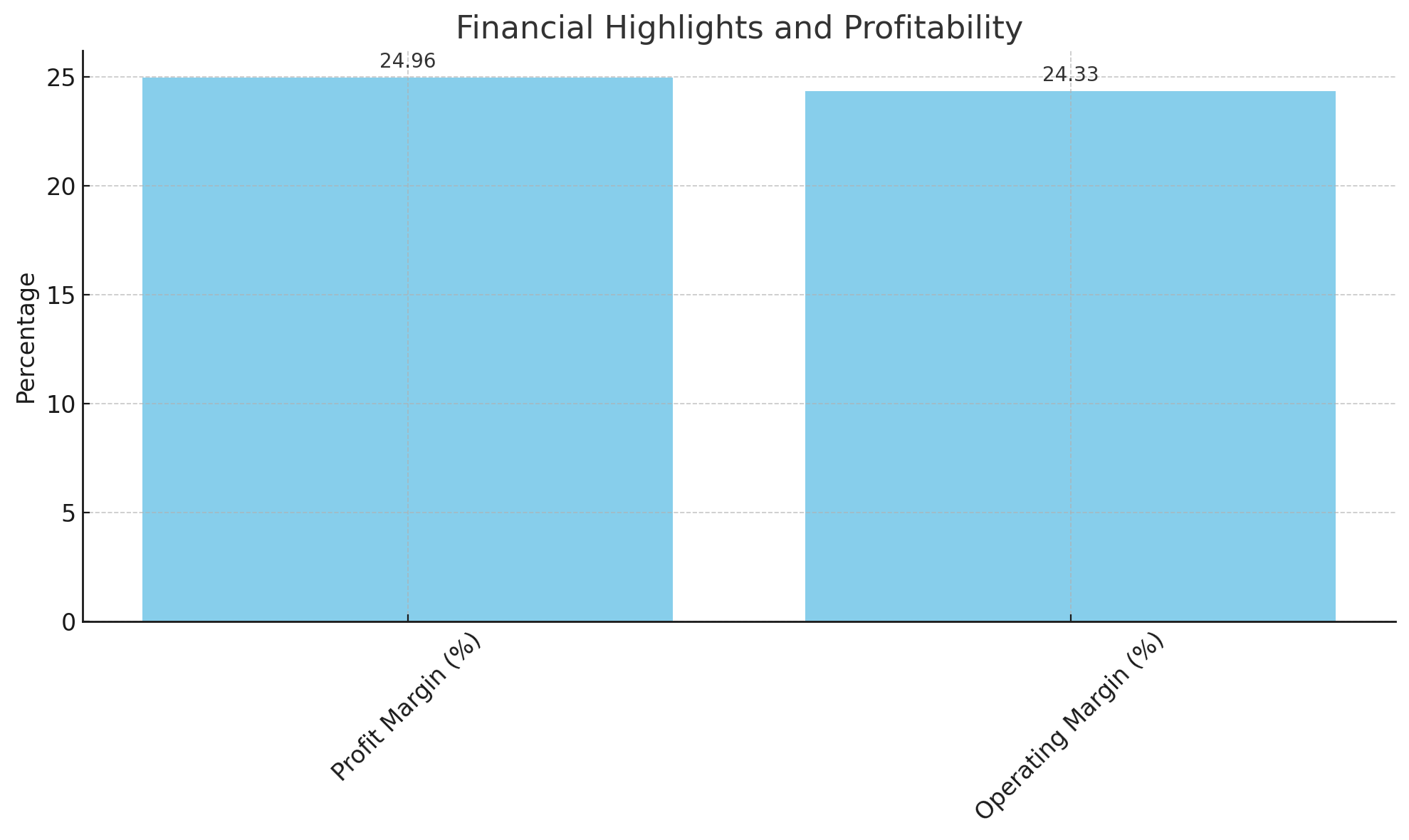

Financial Highlights and Profitability

Pinduoduo's fiscal year ended on December 30, 2022, with the most recent quarter showing a profit margin of 24.96% and an operating margin of 24.33%. These figures demonstrate PDD's efficiency in converting sales into actual profit.

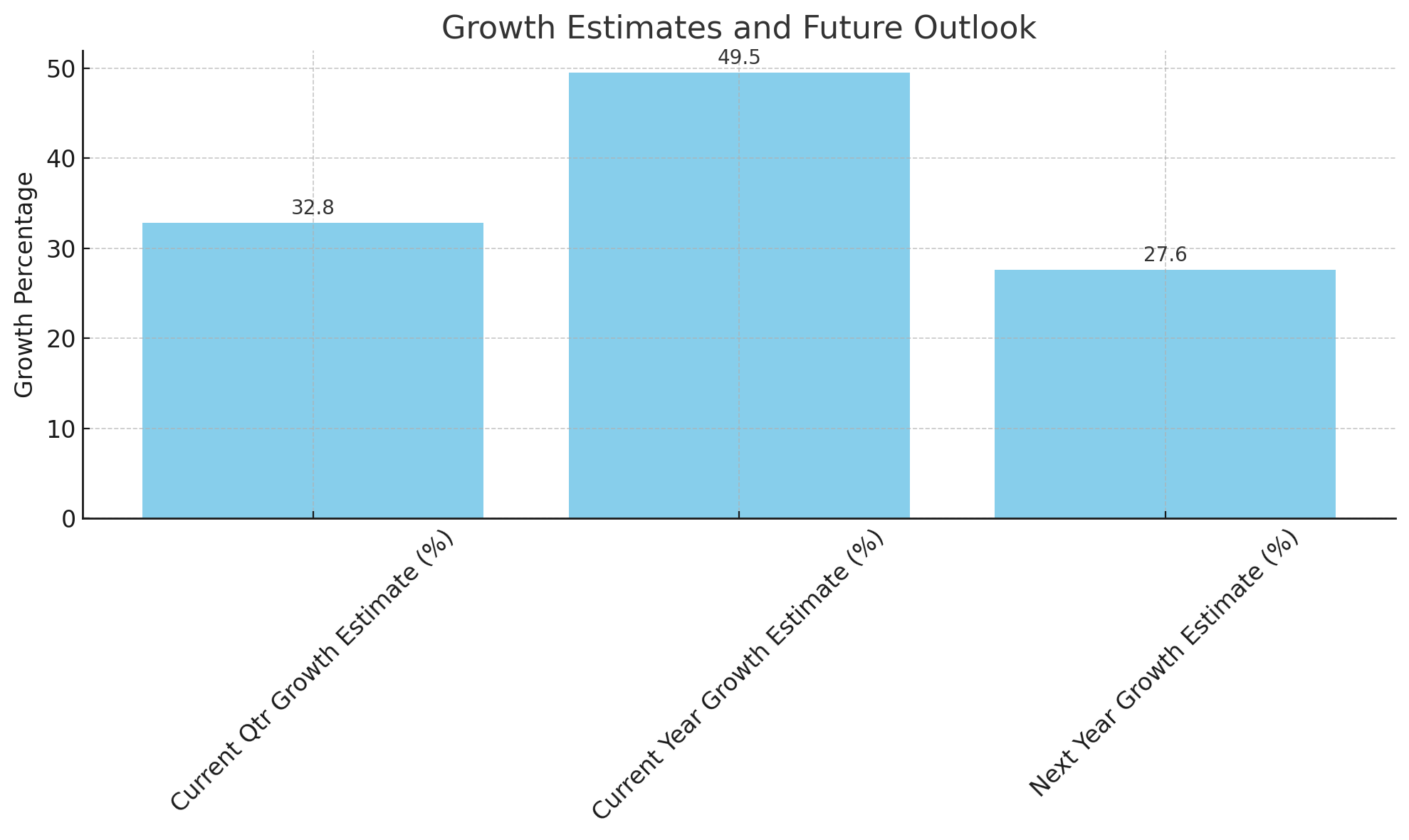

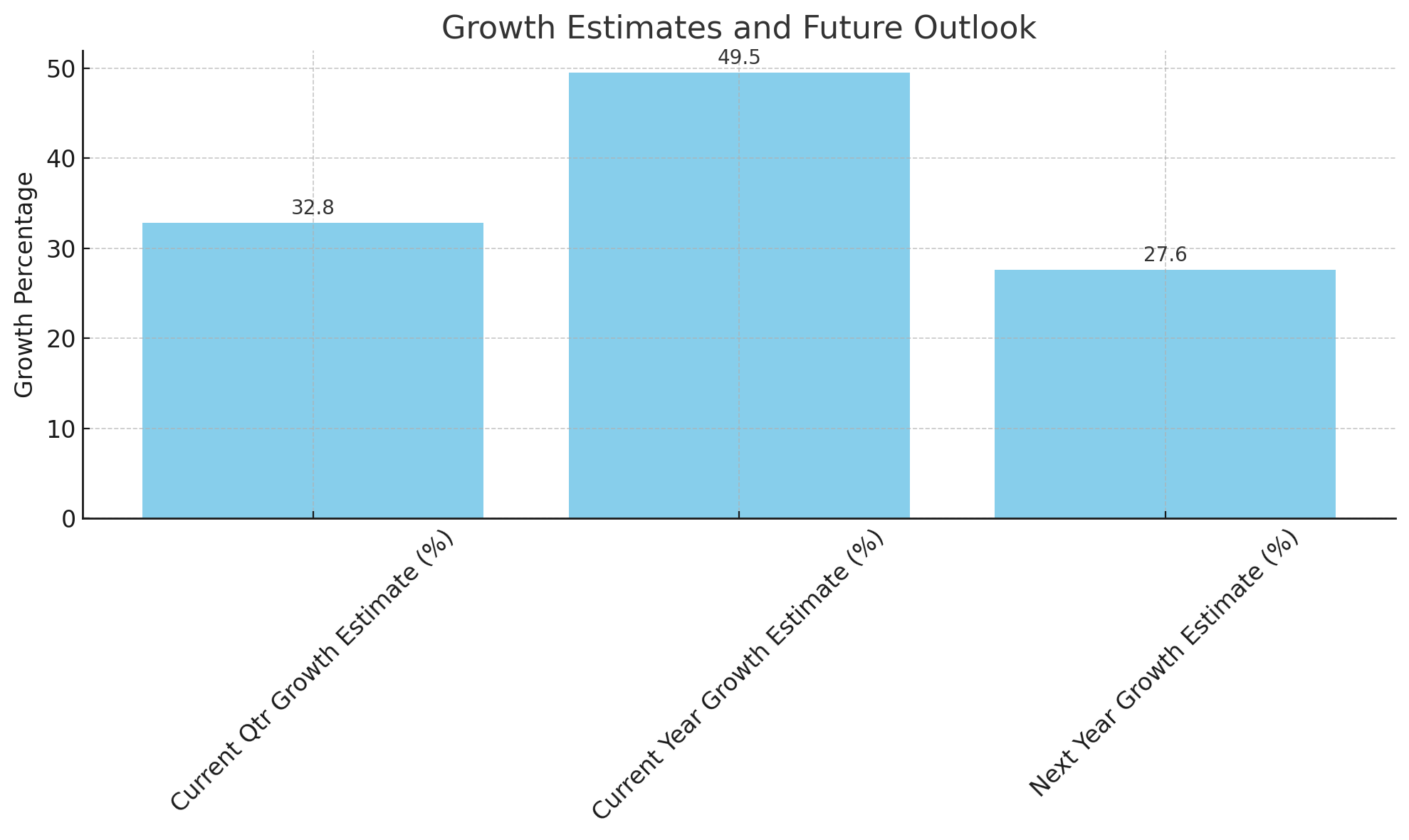

Growth Estimates and Future Outlook

PDD's current quarter growth estimate stands at 32.80%, with a forecast of 49.50% growth for the current year and an anticipated 27.60% for the next year. These growth estimates reflect PDD's potential for continued expansion in the e-commerce sector.

International Expansion and Market Position

Pinduoduo's rapid international growth, particularly through its Temu platform, has been pivotal in its recent surge. This expansion strategy focuses on targeting price-conscious consumers, differentiating it from competitors like Alibaba and JD.com. PDD's innovation in group-buying and emphasis on bargains have been key to capturing market share in less affluent regions in China and gaining traction internationally.

Challenges and Competitive Landscape

Despite its growth, PDD faces challenges, including political scrutiny in the U.S. and intense competition in the fast fashion e-commerce space. Its rivalry with companies like Shein and recent moves by Amazon to capture the low-cost clothing market segment underscore the competitive pressures PDD must navigate.

Strategic Evaluation for Long-Term Growth

PDD's success hinges on its ability to expand internationally while maintaining strong margins and market share in China. Its focus on innovation, customer-centric approaches, and strategic market positioning are crucial for its long-term growth in the highly competitive e-commerce landscape.

Conclusion

Investors considering Pinduoduo should weigh its growth prospects, market strategies, and the challenges it faces in both domestic and international markets. While PDD shows strong fundamentals and innovative business models, the evolving e-commerce landscape and global market dynamics require a nuanced and informed investment approach.

For real-time stock analysis and more information on insider transactions, visit PDD Real-Time Chart and PDD Stock Profile on TradingNews.com.