Overview and Market Position

In the realm of outdoor living products, Trex Company, Inc. (NYSE:TREX) stands as a beacon of innovation and sustainability. Headquartered in Winchester, VA, Trex has carved its niche as the premier provider of composite decking, railing, and accessories, catering to both residential and commercial sectors. With a robust market capitalization exceeding $8.8 billion and a share price hovering around eighty dollars, Trex's financial health and industry stature are solid. The company's dedication to high-performance, low-maintenance, and eco-friendly products has not only earned it the title of the world's leading brand in its domain but also secured its position on Bank of America's top ten short-term ideas list as we usher in 2024.

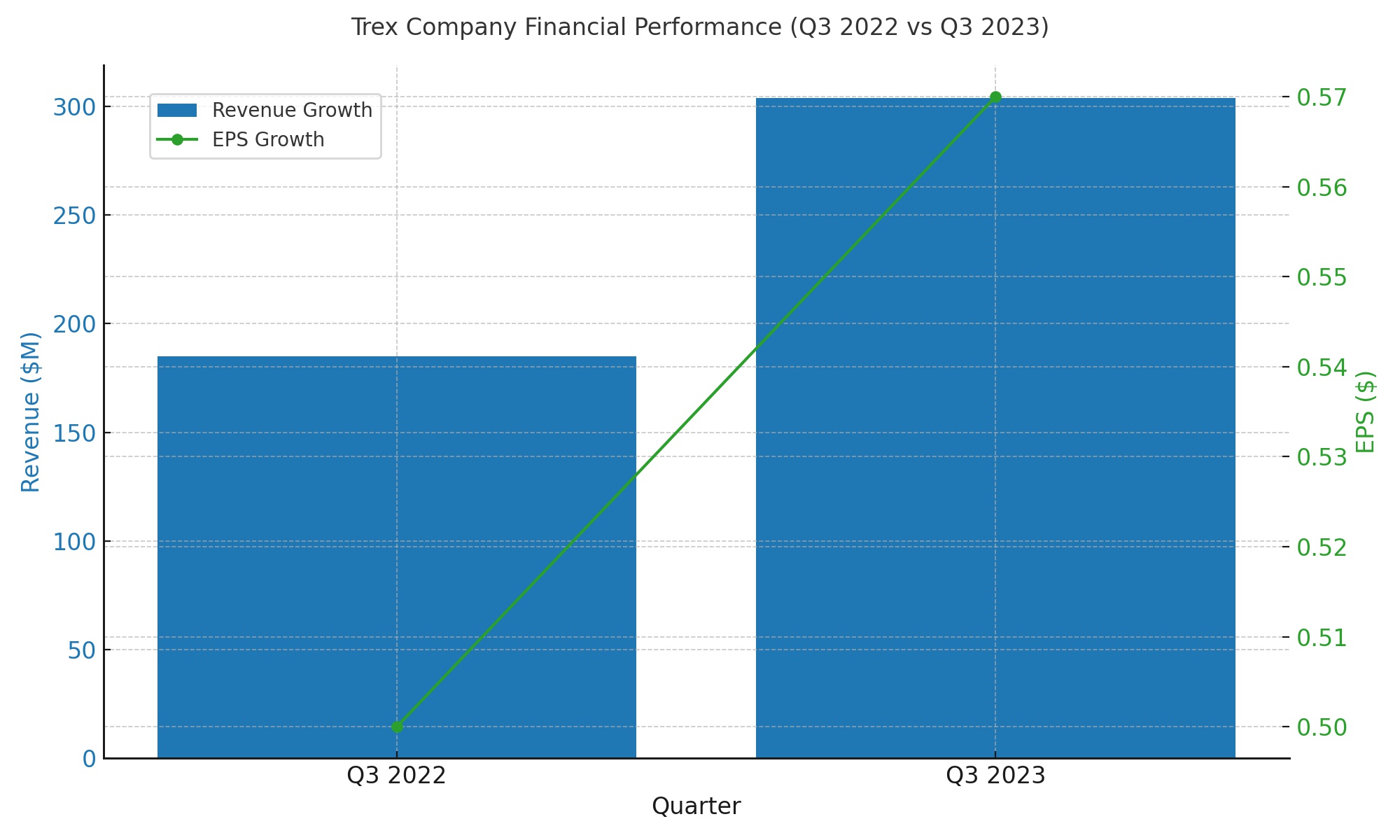

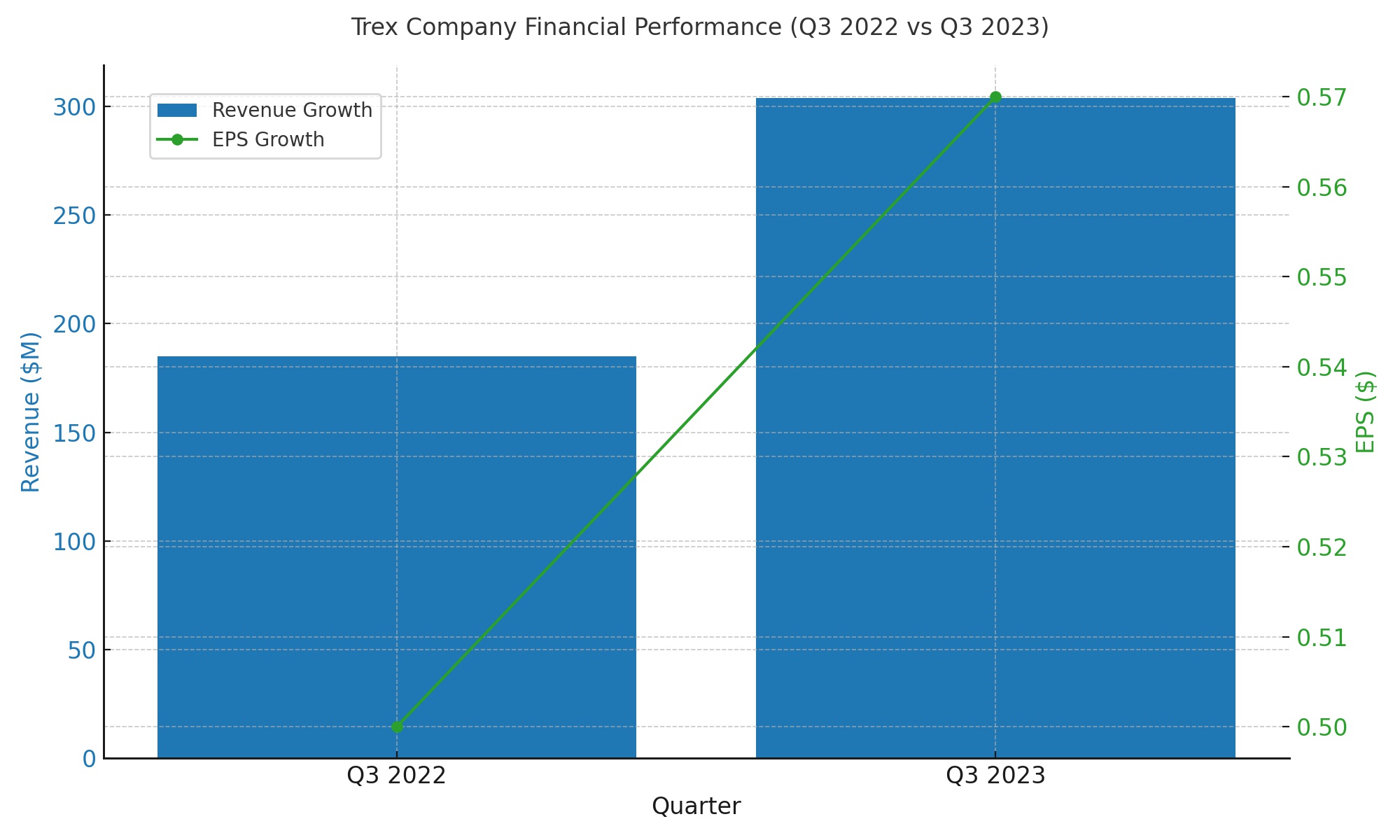

Financial Performance and Strategic Growth

The fiscal narrative of Trex Company is one of strategic acumen and resilient growth. Despite the overarching challenges in the real estate sector, Trex's third-quarter results for 2023 were nothing short of impressive. The company reported a non-GAAP profit of 57 cents per share, surpassing expectations by seven cents, with revenue growth of over 61% year-over-year, reaching $303.8 million. This performance underscores Trex's adeptness at navigating market dynamics, further evidenced by its projected sales of $1.09 billion for FY2023. The strategic divestiture of its commercial division in 2022 and the appointment of a new CFO highlight Trex's commitment to focusing on core strengths and optimizing financial leadership.

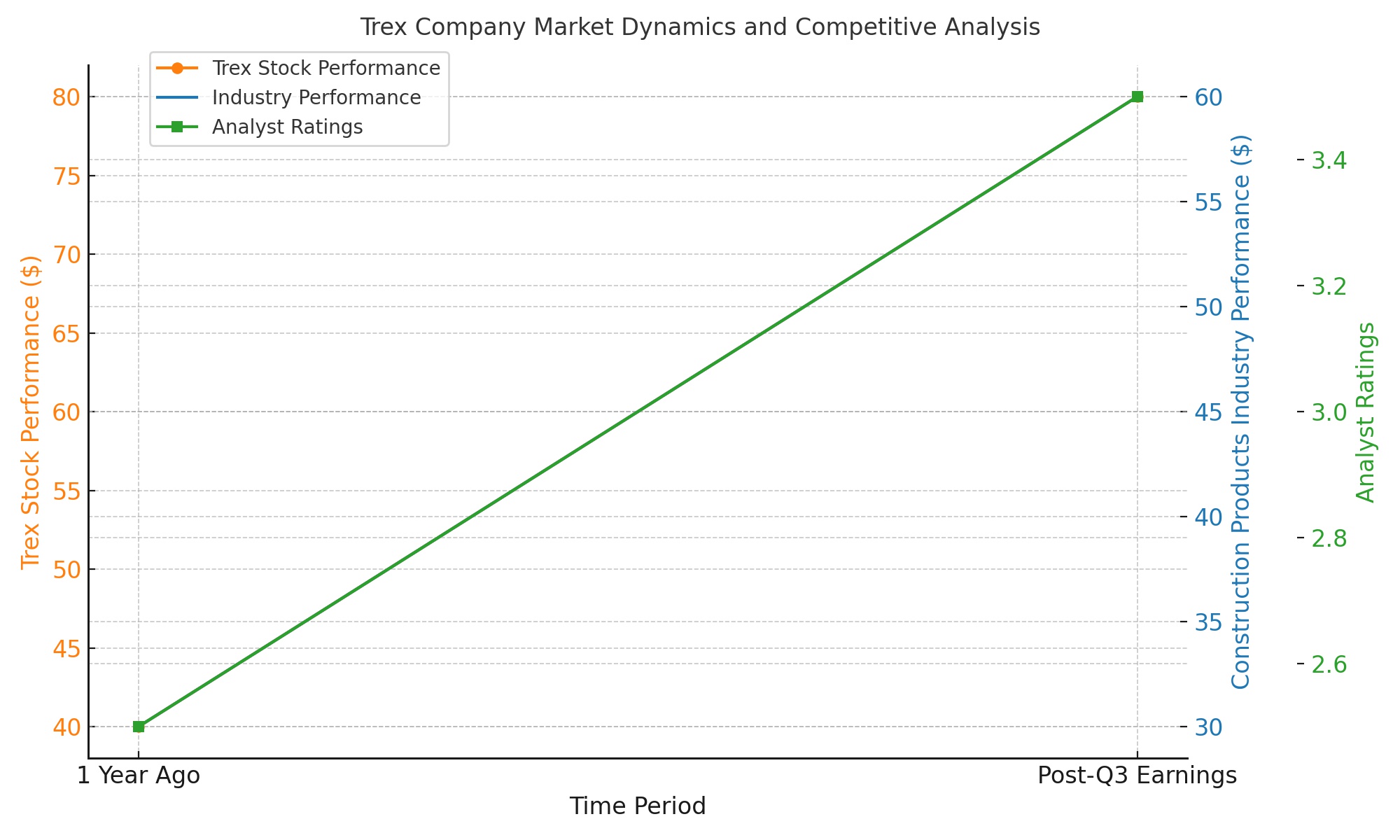

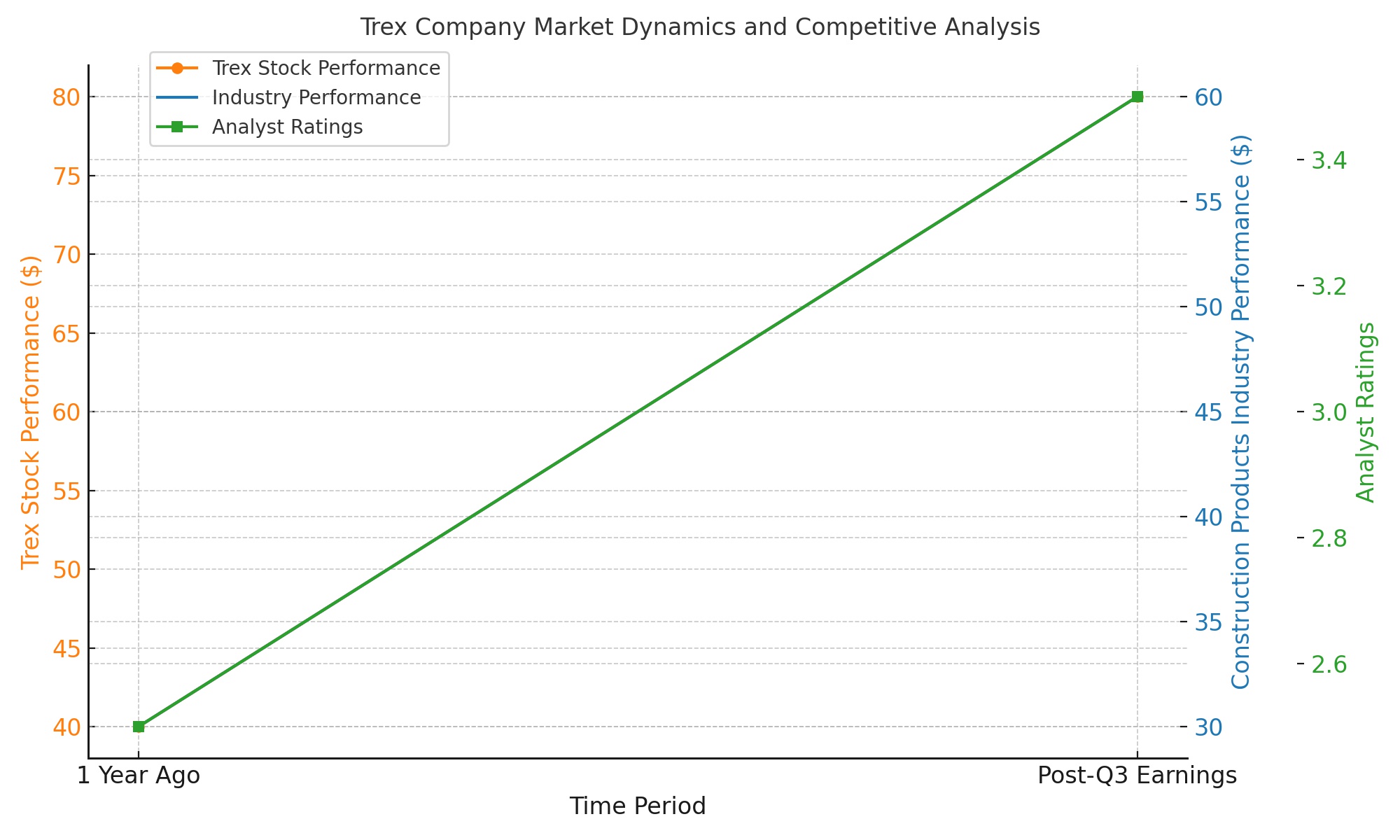

Market Dynamics and Competitive Analysis

The stock market's reception of Trex provides a compelling study in contrast. Despite the perceived overvaluation amid a sluggish housing market, Trex's stock has surged nearly 60% in the past year. This bullish sentiment is mirrored in its breakout performance post-third-quarter earnings announcement, with shares appreciating significantly and outpacing the broader construction products industry. However, a mixed analyst outlook, with ratings ranging from Hold/Sell to Buy across prominent firms, reflects the market's cautious optimism about Trex's future trajectory.

Operational Efficiency and Insider Loyalty

Trex's operational prowess is evident in its cash flow generation, with $288 million in operating cash flow reported in the first nine months of 2023. This financial health is complemented by a noteworthy insider loyalty, as evidenced by the absence of insider activity since 2021. Such stability is rare and speaks volumes about the confidence insiders have in the company's direction and governance.

Forward-Looking Analysis

As we look ahead, Trex's strategic positioning within the outdoor living product sector appears robust. The company's focus on sustainable and innovative composite materials positions it well to capitalize on the growing trend away from traditional wood products. However, the valuation metrics suggest a cautious approach for investors. With the stock trading at a significant premium over earnings and sales, juxtaposed against a backdrop of modest sales growth projections and a challenging housing market, the investment thesis for Trex requires a nuanced understanding of its long-term growth potential versus current market dynamics.

Investment Considerations

In conclusion, while Trex Company, Inc. showcases a strong foundation of innovation, market leadership, and financial health, potential investors must weigh the company's growth prospects against its current valuation and broader economic indicators. With the housing market's recovery uncertain and Trex's valuation at a premium, the decision to invest should be informed by a balanced consideration of risk and reward, alongside a keen eye on market trends and company performance indicators.

For a deeper dive into Trex Company's financials, strategic initiatives, and market position, prospective investors and interested parties are encouraged to explore detailed stock profiles and insider transaction data available through comprehensive financial platforms like Trading News and Trex's Stock Profile.

That's TradingNEWS