Warner Bros. NASDAQ:WBD - Mastering the Media Evolution

In-depth Look at WBD's Market Dynamics, Financial Resilience, and Strategic Growth in the Changing Entertainment Industry | That's TradingNEWS

Warner Bros. Discovery (NASDAQ:WBD): Comprehensive Industry Analysis

Introduction: Assessing Warner Bros. Discovery’s Market Position

Warner Bros. Discovery (NASDAQ:WBD), emerging from a significant merger, faces a challenging media landscape. The company, blending WarnerMedia’s storied content with Discovery's reality programming strength, initially projected optimistic growth. However, real-world performance has been more complex, marked by a significant stock price decline and ongoing strategic recalibrations.

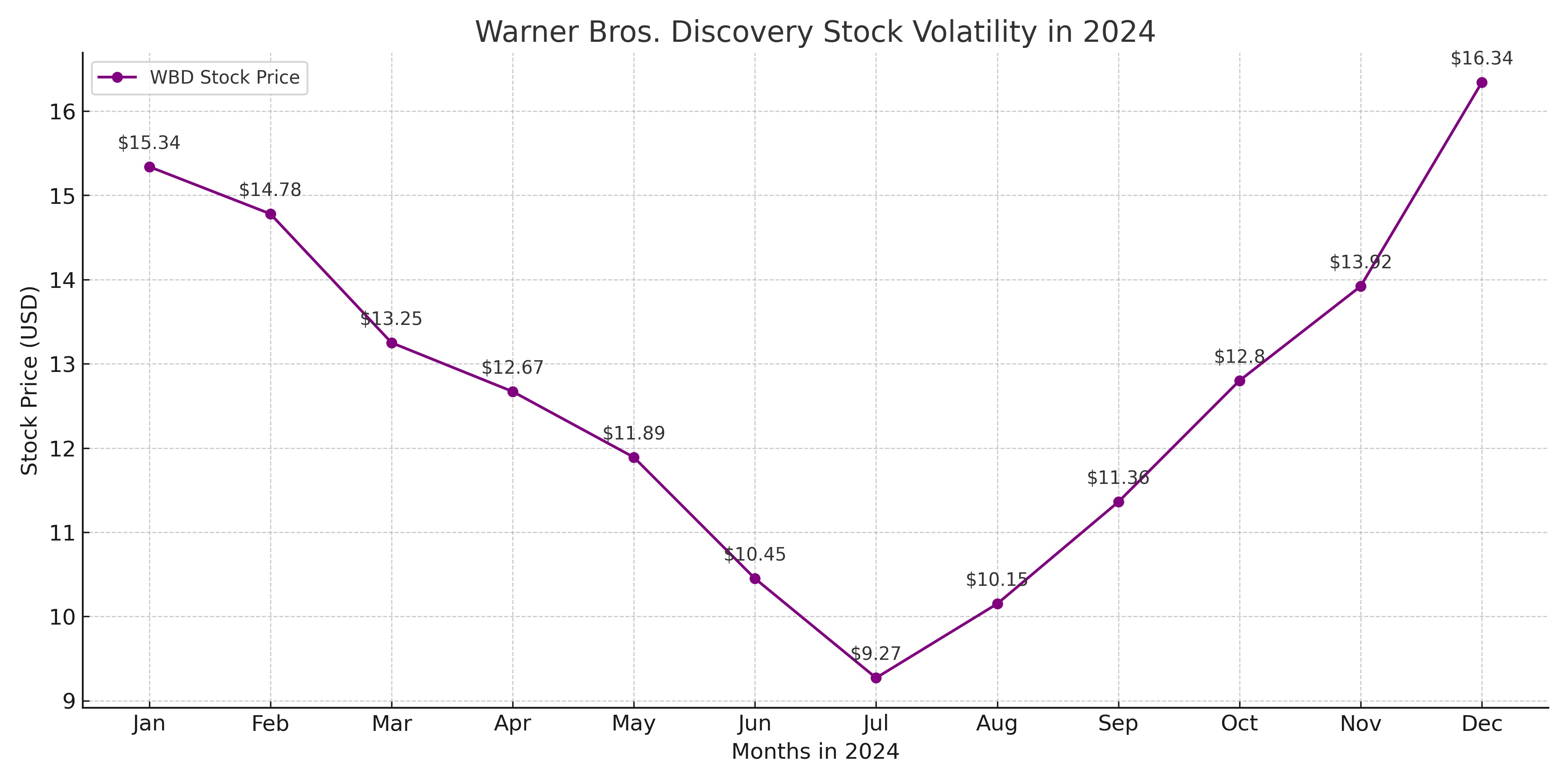

Market Performance and Stock Volatility

As of 2024, WBD's stock demonstrates volatility within a fluctuating industry. The company's market capitalization, currently around $24.58 billion, and its performance on the NASDAQ reflect both the challenges and potential within the media and entertainment sector. The stock's movement, from a 52-week range of $9.27 to $16.34, indicates investor response to the company's evolving strategy and broader market trends.

Strategic Merger and Post-Merger Realities

The merger, intended to position WBD competitively against giants like Netflix and Disney, aimed to leverage a rich content library and capitalize on streaming growth. However, post-merger realities, including a heavy debt load, declining linear TV revenue, and integration challenges, have led to a reassessment of initial optimistic forecasts.

Content Portfolio and Competitive Landscape

WBD’s content portfolio, including DC Comics, Game of Thrones, and CNN, positions it uniquely in the content-rich media landscape. The company's strategy to maximize IP value, especially against competitors like Disney's Marvel and Star Wars franchises, is crucial. Recent underperformance in these Disney franchises presents WBD with a unique opportunity to capture audience attention and market share.

Financial Health and Debt Management

WBD’s financial health, particularly its management of a significant debt burden, is a key focus area. The company's strategies to reduce debt while investing in content and streaming platforms are vital for long-term sustainability. The ability to manage financial obligations against revenue generation from content and streaming services is crucial for investor confidence.

DTC (Direct-to-Consumer) Segment and Global Expansion

WBD's Direct-to-Consumer segment, including streaming services, is central to its growth strategy. The company’s plans for global expansion and investment in DTC platforms, like HBO Max, are aimed at increasing subscriber base and revenue. The performance of these platforms, especially in the competitive streaming market, is critical for WBD’s success.

Studio Segment and Future Content Pipeline

The Studio segment, encompassing film and TV production, is a significant revenue generator for WBD. The company’s future content pipeline, including plans for increased theatrical releases and investment in gaming, is expected to drive profitability. The success of recent and upcoming releases, such as "Barbie" and "Wonka," and the revitalization of franchises like DC, are essential for the studio's financial performance.

Insider Transactions and Shareholder Insights

Insider transactions at WBD offer insights into management’s confidence in the company’s future. Tracking these transactions can reveal internal perspectives on strategic decisions and potential future directions. For detailed insider transaction information, shareholders and investors can refer to WBD Insider Transactions.

Further Exploration: Evolving Dynamics in the Media Industry

The media industry’s dynamics, including shifts in consumer preferences and technological advancements, directly impact WBD. The company's strategy in adapting to these changes, especially in content delivery and consumption patterns, is crucial for staying relevant and profitable.

Insider Analysis: Management’s Strategic Decisions

WBD's management decisions, particularly in content strategy, debt restructuring, and DTC investments, are key to navigating the media landscape. CEO David Zaslav’s leadership and the executive team’s strategic choices will significantly influence the company's trajectory and shareholder value.

For ongoing updates and comprehensive market analysis, WBD's stock profile offers valuable insights into the company's performance and strategic direction.

Evolving Entertainment Industry and WBD’s Positioning

The entertainment industry, valued at approximately $2 trillion globally, is witnessing a seismic shift with streaming services expected to reach $330 billion by 2025. In this dynamic landscape, Warner Bros. Discovery (WBD) must pivot effectively. The company is vying for a slice of the streaming market, which is projected to grow at a CAGR of 21% from 2021 to 2028.

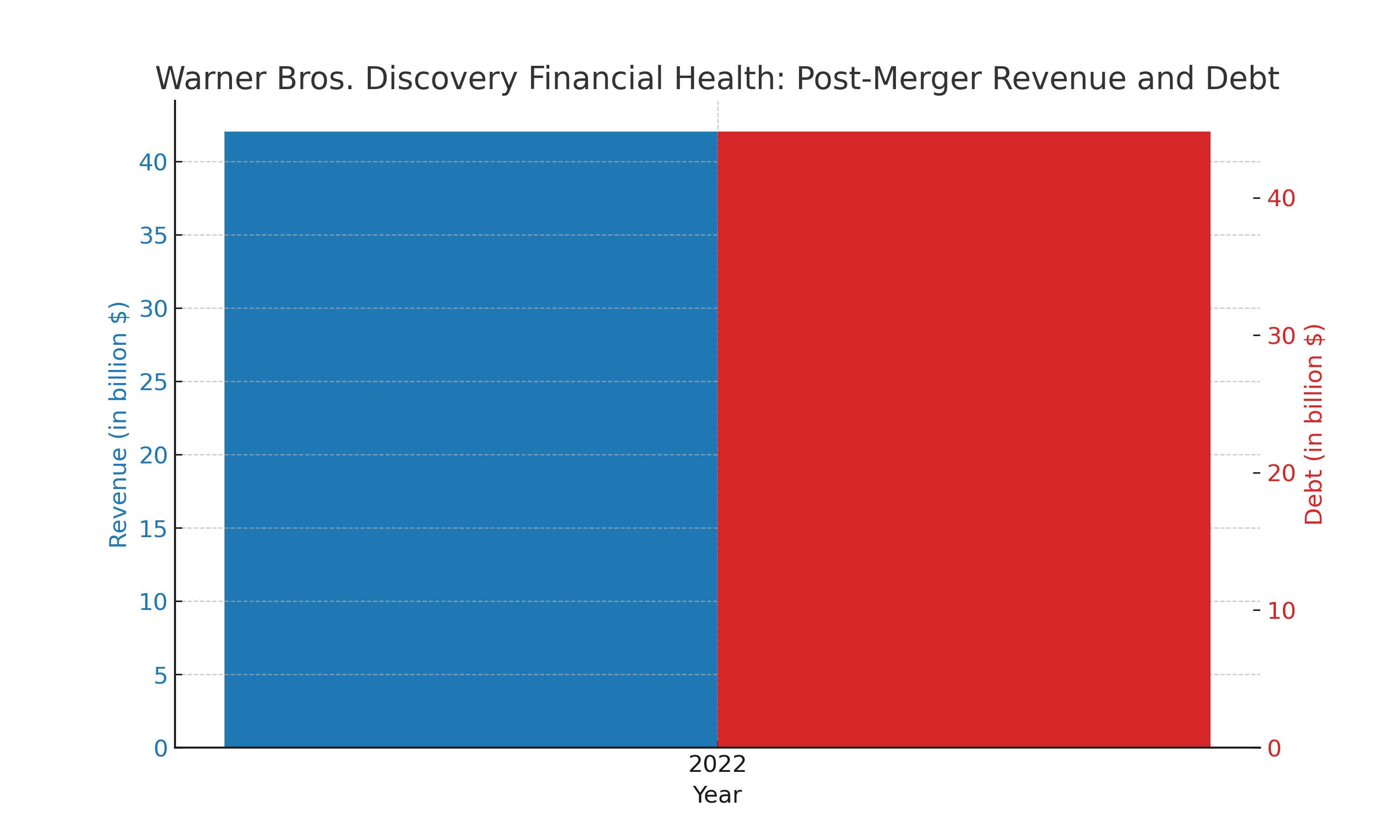

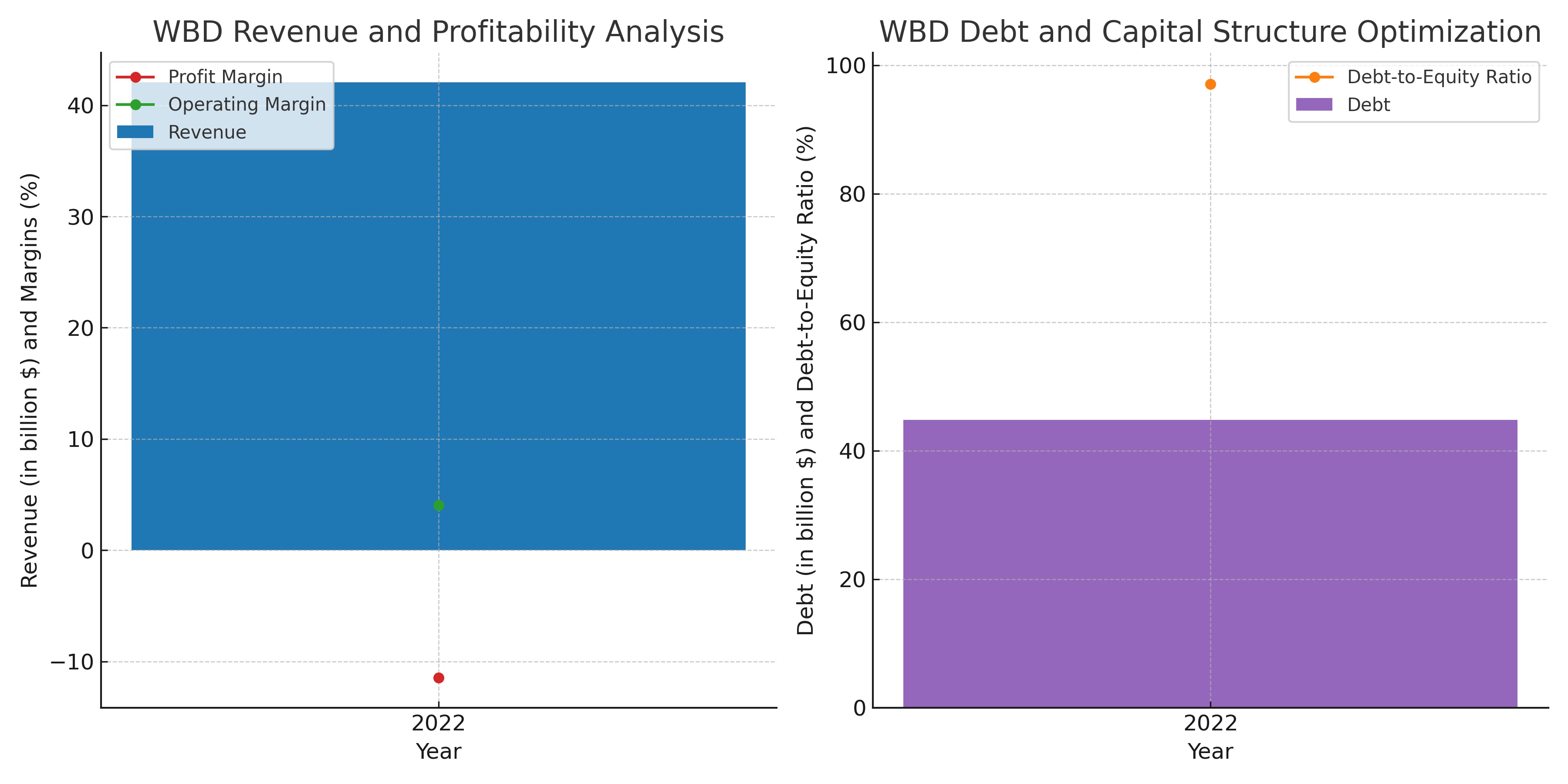

Financial Analysis: Revenue and Profitability

WBD’s financial performance is a mix of challenges and opportunities. For FY 2022, its revenue was reported at around $42.05 billion, a slight increase from the previous year. However, the profitability landscape is more complex. WBD reported a negative profit margin of -11.48% and an operating margin of 4.04%, underscoring the need for more efficient operations. Its EBITDA stood at $6.87 billion, indicating potential for improvement.

Debt Reduction and Capital Structure Optimization

WBD’s debt burden, post-merger, stands at a staggering $44.81 billion, with a debt-to-equity ratio of 97.11%. Reducing this debt is crucial for financial stability. The company’s efforts in restructuring its debt and optimizing capital structure could be pivotal in regaining investor confidence.

Content Strategy and IP Monetization

WBD’s diverse content portfolio, including DC Comics and CNN, offers significant monetization opportunities. For example, the 'Harry Potter' franchise alone has generated over $7.7 billion in box office revenues globally. WBD’s strategy in leveraging such IPs through multiple channels is crucial for revenue growth.

Streaming Services Growth and Competitive Strategy

WBD’s streaming service, HBO Max, is a key player in a market dominated by Netflix and Disney+. As of Q3 2023, HBO Max had over 69.4 million global subscribers, contributing significantly to WBD’s DTC revenues. The company's focus on expanding its streaming services internationally and diversifying content offerings is vital in capturing more market share.

Advertising Revenue and Market Trends

Advertising revenues are crucial for WBD, especially in its Networks segment. The global TV advertising market size is expected to reach $192.6 billion by 2027. WBD’s ability to tap into this market through innovative advertising strategies, especially in digital platforms, is essential to offset the decline in traditional TV viewership.

Risk Assessment and Future Outlook

WBD faces risks from market competition, technology shifts, and economic factors. With the global entertainment and media market expected to grow to $2.6 trillion by 2025, WBD’s strategies in content creation, digital transformation, and market expansion will be crucial. The company’s adaptability and innovation will determine its future growth trajectory in the ever-evolving media landscape.

Conclusion: Assessing WBD’s Investment Prospects

In conclusion, Warner Bros. Discovery's position in the evolving media industry hinges on its ability to manage debt, leverage its content library effectively, and adapt to market changes. With a market capitalization of approximately $24.581 billion and a forward-looking strategy, WBD presents both challenges and opportunities for investors. A careful evaluation of its financial performance, market trends, and strategic initiatives is key to assessing its long-term investment potential. For ongoing updates and comprehensive analysis, Warner Bros. Discovery’s stock profile and insider transaction reports offer valuable insights.

Read More

-

Google Stock Price Forecast - AI Capex Shock, Cloud Breakout and What $313 Really Prices In

12.02.2026 · TradingNEWS ArchiveStocks

-

XRP Price Forecast: XRP-USD Stuck Between $1.34 Support And $1.50 Ceiling

12.02.2026 · TradingNEWS ArchiveCrypto

-

Oil Price Forecast: WTI Around $63 And Brent $68 Trapped Between Oversupply And Gulf Risk

12.02.2026 · TradingNEWS ArchiveCommodities

-

Stock Market Today: Dow Jones Holds 50,000 While S&P 500 Steadies and Nasdaq Sinks on Cisco & AppLovin Rout, CPI Looms

12.02.2026 · TradingNEWS ArchiveMarkets

-

GBP/USD Price Forecast - GBPUSD=X Stalls Around 1.3630 as Weak UK GDP Meets Robust US Jobs Data

12.02.2026 · TradingNEWS ArchiveForex